2022 Issue 03

New Opportunities for Operator Transformation

Whether it is leading the digital transformation of traditional industries or guiding cross-sector innovation, the door to the future is wide open for telecom operators! This issue of Huawei Tech deep dives into new business opportunities waiting to be explored.

How Carriers Can Boost Revenues with All-scenario FWA

As more nations deploy 5G, the potential for growth in home, enterprise, and IoT scenarios can offer carriers higher ARPU, better pipe monetization opportunities, and a superior user experience if they implement optimum strategies.

FWA: From copper lines to optical fiber

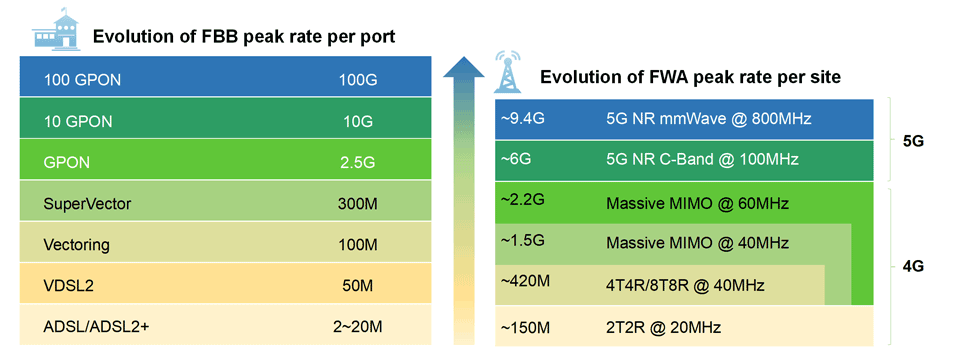

Unconstrained by physical lines, wireless connections are more flexible and easier to use than wired connections. The rapid evolution of wireless technologies has boosted the capacity of FWA from satisfying basic connectivity needs to replacing copper lines with even higher speeds. FWA has great potential to compete with FTTx, with the peak rate of a 5G site at a single frequency band already comparable to wired 10G PON.

Figure 1: Peak capacity evolution of FBB and FWA cells

If carriers use 60% of the resources in 2.3 GHz and 3.5 GHz bands to develop FWA, the peak FWA capacity of a single site can reach 8.6 Gbit/s. TDD spectrum distribution for continuous high bandwidth is a common approach taken in many countries that enables 5G FWA capacity to be comparable to that of wired 10G PON.

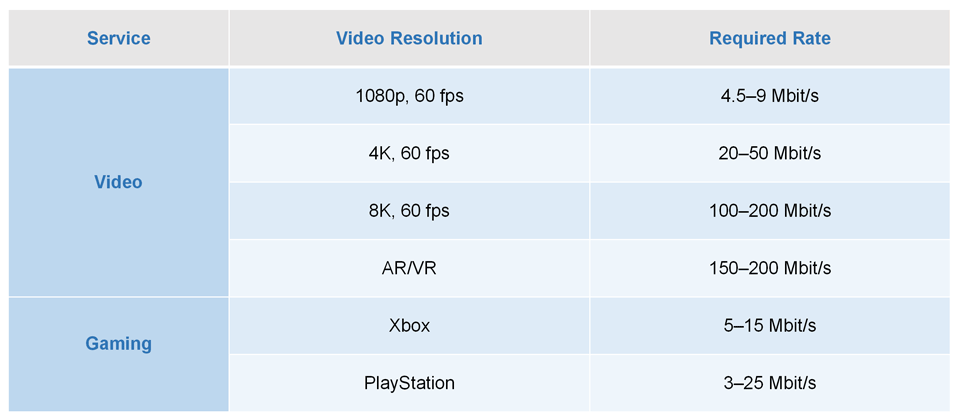

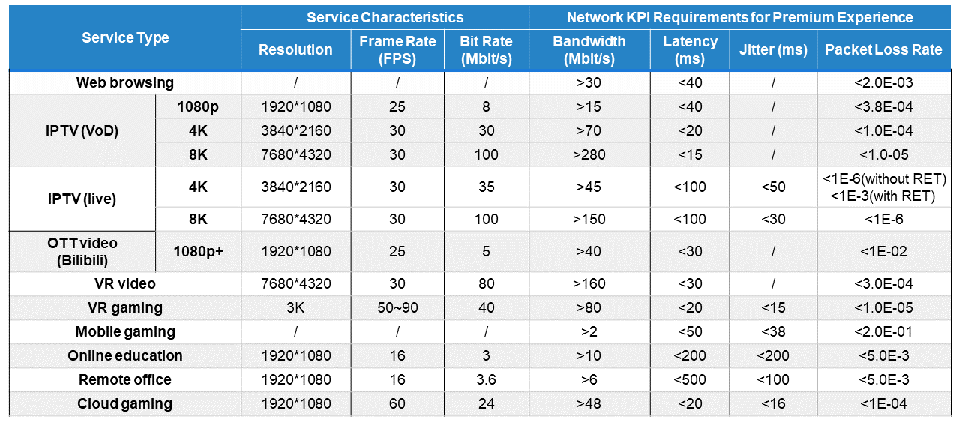

FWA development at scale depends on what home broadband users need. In China, the 100 Mbit/s fixed network home broadband package in a tier-1 city in China provides a good example. Excluding IPTV, 8 Mbit/s is sufficient to meet home user needs, as mainstream home services are 480p and 720p OTT videos. For the next three to five years, 100 Mbit/s will be sufficient to meet the needs of most households.

Figure 2: Bandwidth requirements of services

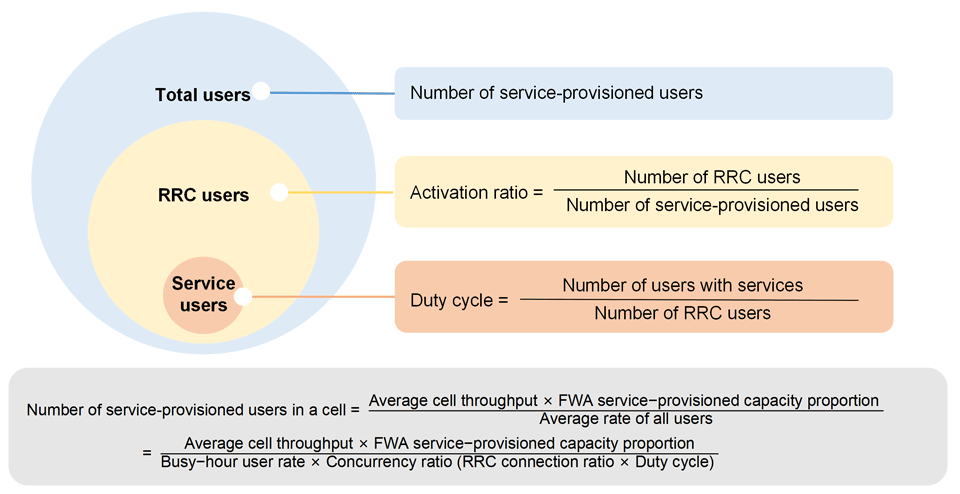

FWA services should be provisioned and planned based on user needs and wireless service characteristics. The number of households for which FWA services can be provisioned by a single site depends on the capacity of a wireless site, FWA traffic model, and the service rates users need.

Figure 3: Model of the number of users for which wireless FWA service can be provisioned

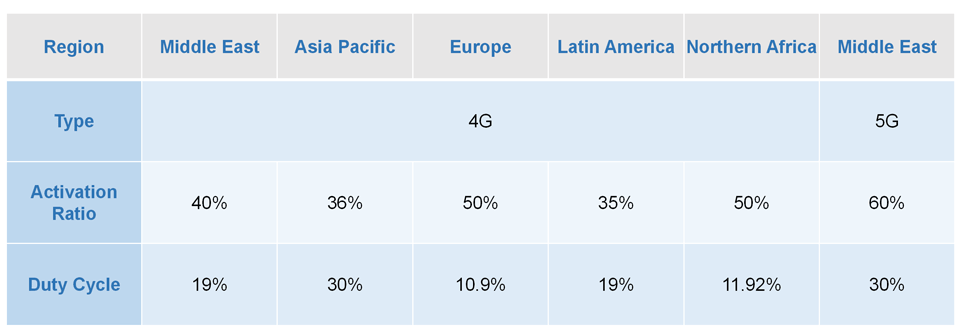

According to an FWA traffic model data in different regions worldwide, assuming the rate that FWA users need is 50 Mbit/s when the FWA capacity is 8.6 Gbit/s per site, the activation ratio and duty cycle are 50% and 20%, respectively, maximum of 1,720 users can be provisioned in one site. This addresses the urban household density and home broadband rate requirements in most countries.

Figure 4: Typical FWA traffic models in different regions worldwide

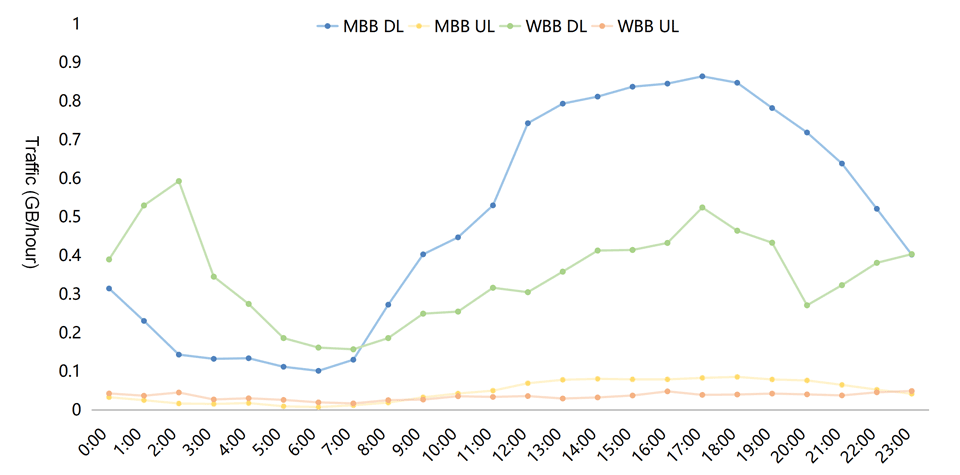

FWA packages are mainly speed-based or volume-based with larger-data packages, with prices per GB lower than 5GtoC packages. In the early stages of 5G development, mobile broadband (MBB) networks were generally light load due to the low penetration rate of user devices. In addition, MBB's consumption of wireless resources is unbalanced in terms of time and space, and the busy hours of eMBB and FWA do not overlap. Efficient use of MBB resources during off-peak hours to develop FWA brings more benefits with quicker ROI. FWA is clearly a more efficient means of monetizing pipes.

Figure 5: Traffic distribution of FWA and MBB at different times

The Future of FWA: 20% CAGR of users and significant market share outside China

By the end of 2021, the number of 4G/5G FWA users worldwide exceeded 65 million, with 4G FWA users accounting for 95% of the total. 5G FWA users are expected to account for 27% of all users by 2025. As 5G capacity increases exponentially, FWA has become mainstream.

In the Middle East, more than 1 million 5G FWA home broadband users provide carriers with 30-80% higher ARPU than 4G FWA. In western Europe, 5G FWA has been applied in many scenarios, including SMEs and RVs.

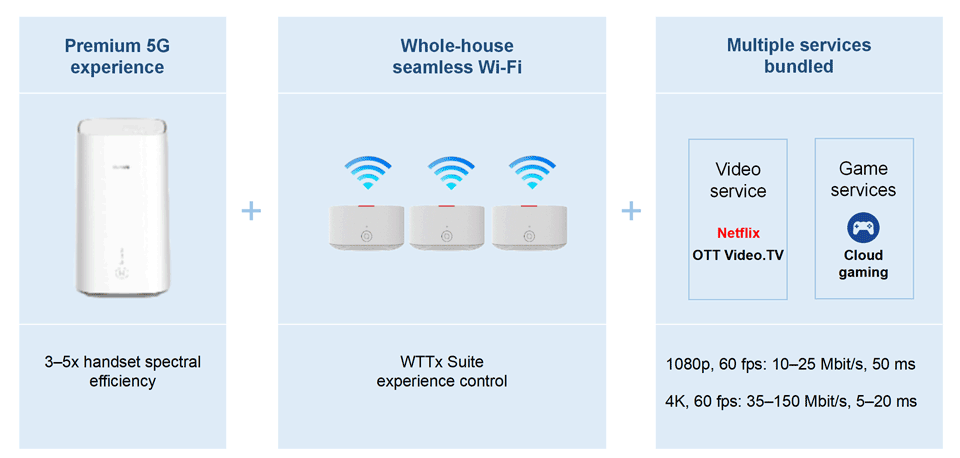

The FWA development experience of leading carriers worldwide shows that while 5G FWA improves perceived speeds, providing diverse bundled services is key. According to Huawei data, more than 80% of carriers that provide commercial 5G FWA offer packages that bundle Wi-Fi mesh, video, and gaming services. Huawei's recommendation for such carriers is the 1+1+X strategy, which means one high-performance air interface that improves the home broadband rate, one seamless Wi-Fi coverage solution, and a variety of home services such as 4K OTT video and cloud gaming.

Figure 6: 1+1+X wireless FWA service development strategy

The development of FWA services at scale creates requirements for CPE prices. Developed markets are less sensitive to CPE costs, and so business model design is more important. In markets with fair credit systems, such as North America, the Middle East, and Europe, CPE costs can be dispersed through leasing or installment. In developing markets sensitive to CPE prices, 4G and 5G coordination is needed. To generate higher ARPU, carriers can develop entry-level users through 4G CPE with competitive pricing, and high-end users with 5G CPE with similar pricing to optical fiber solutions.

Understanding broadband IoT from the FWA perspective

The advent of 5G has clearly helped FWA expand from homes to enterprises. For example, work from anywhere is an FWA business scenario for SMEs that provides guaranteed connectivity, as well as work suites, including online meeting software, telephony services, and 24/7 assurance services. The core of these services is to go beyond connectivity and provide micro-integrated, differentiated capabilities. Based on its expertise gained from around the world, Huawei has summarized 12 private line use cases, including SME private line and mobile banking, which are differentiated product portfolios based on FWA connectivity. By July 2021, 27 carriers had worked with Huawei to launch 5G FWA Business services.

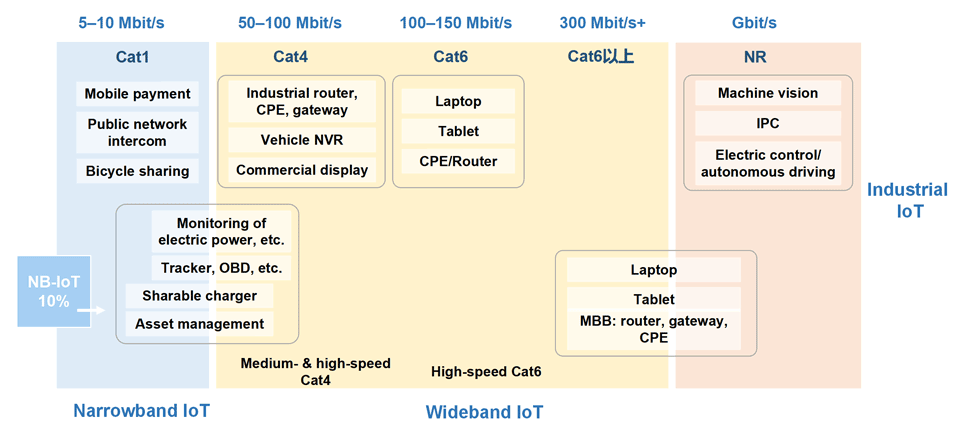

FWA can connect homes, enterprises, and everything. The parcel lockers and vending machines that can be found everywhere are all based on Cat4 broadband connections. Broadband connectivity integrates both narrowband IoT (NB-IoT) and high-bandwidth 5G NR. In terms of IoT, the value of connectivity for NB-IoT generally accounts for less than 10% across the industry value chain. Most of the value lies in devices, platforms, and applications. This conclusion is in line with the need for FWA enterprise connectivity to move upstream by providing micro-integration. Carriers should consider developing integration capabilities that match value distribution along the industry value chain.

Figure 7: Broadband IoT application scenarios and required rates

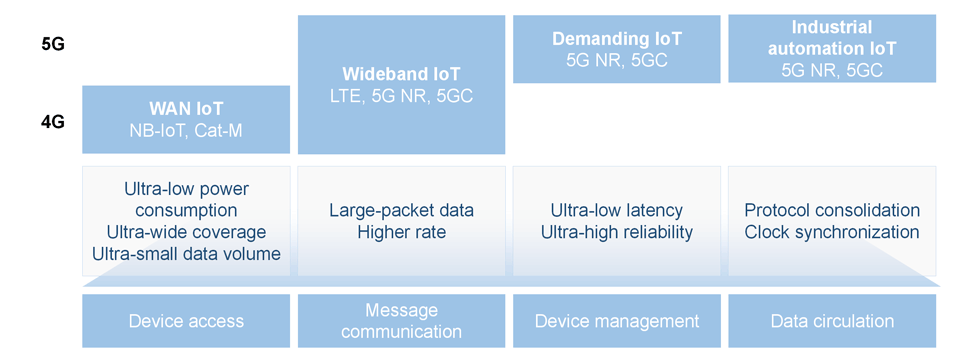

5G's main advantage over 4G is support for ultra-low latency and ultra-high bandwidth, which enables two types of high-value IoT toB scenarios: Critical IoT and industrial automation IoT. These scenarios require high reliability and low latency, as well as support for features such as 5G LAN and clock synchronization. Massive IoT and broadband IoT are essentially a continuation of 4G connectivity.

Figure 8: Four types of IoT connectivity scenarios

Regarding the connectivity scenarios and their value, the following conclusions can be drawn:

- ToC services connect people, and have a large number of users and high value.

- FWA home connectivity is a type of broadband IoT with a massive user market. Carriers must design services based on wireless characteristics, and the core of these services is to adapt busy-hour rates to users' service needs.

- The business model for most Massive IoT services, including NB-IoT and Cat1/Cat4 connectivity, is retailing SIM cards and charging by traffic, which generates low ARPU.

- As a type of broadband IoT, FWA enterprise connectivity is a high-ARPU scenario. Carriers have started to incubate this scenario at scale, but they must be able to integrate and provide differentiated services. For business model design, carriers can use fixed private lines as a reference, but must adapt it to wireless features. Currently, enterprise services with high symmetric uplink and downlink rates (≤50 Mbit/s) are not recommended.

- Critical IoT and industrial IoT are both high-value scenarios. They are differentiated 5G capabilities superior to 4G and are key capabilities for application in vertical industries. They can contribute to the high-value monetization of connectivity.

Unlimited value of network slicing: WAN toB from the FWA perspective

From a geographical point of view, connectivity can be divided into WANs and LANs. WAN connectivity is based on MBB networks with nationwide coverage, whereas LAN connectivity is based on local area networks. FWA falls within the scope of WAN connectivity. While the biggest challenge facing WAN FWA is the impact of multi-service networks on the toC service experience, the biggest challenge for WAN toB services is balancing the impact of multi-service networks on the toC service experience.

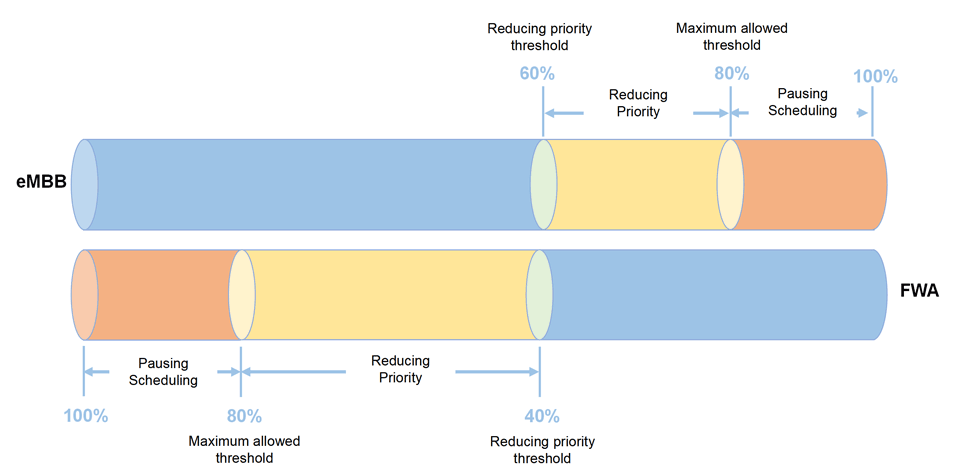

How does FWA balance the experience of multiple services and reduce the impact on the toC service experience? The solution is to use the FWA Suite tool to perform evaluation before service provisioning by evaluating signal quality in real time where the services are provisioned, and calculating the required resources based on the spectral efficiency of the air interface. QoS resource scheduling can set the upper limit of resources usable by FWA. The toC service experience can be ensured using priority-based scheduling during congestion. Given the limited air interface capabilities, the essence of this solution is to allocate resources appropriately and achieve basic slicing of air interface resources.

The recommended method to balancing the multi-service experience on a WAN is as follows: If resources are limited, split the limited resources for toC, toH, and toB services. Then deploy and optimize wireless pipes to accommodate multiple services. If spectrum resources are sufficient and user development is expected to be positive, dedicated networks can be deployed for new services. For example, TDD spectrum can be used to deploy FWA toH/toB dedicated networks.

Figure 9: QoS PRB control solution for multi-service networks

E2E slicing is a key capability to meet differentiated service requirements of different industries using WAN toB services such as speed acceleration, security isolation, and service assurance. The following FWA guidelines can be used as a reference for WAN slicing:

1. Absolute hard slicing should be used with caution on WANs. Before toB service provisioning, it is recommended that you use the FWA Suite tool to evaluate the resources needed by users before toB service provisioning. Doing so can avoid resource preemption that compromises consumer service experience. Soft slicing based on QoS scheduling priorities is more secure.

2. Hard slicing applies to these scenarios: occupation of a small number of resource blocks (RBs), temporary hard slicing (released upon exhaustion), and hard slicing within a small geographic area (toC hot areas should be avoided).

3. Hard slicing on a dedicated network that is isolated from toC resources does not need to consider its impact on toC service experience. This will maximize toB service experience. 5GtoB dedicated LANs support demanding IoT and industrial IoT, and are superior to WANs in this regard.

The key to all types of connectivity carried on a wireless network is to build pipes with sufficient bandwidth. Only a road that is wide enough can accommodate a large number of vehicles through shared lanes, dedicated lanes, and tidal lanes. This type of road enables more options and a greater vision of the future.

FWA is a solution positioned somewhere between wired and wireless networks, and a crossover product for both homes and enterprises. FWA can involve both narrowband and wideband IoT, and evolves from 4G to 5G. Huawei works to make FWA the ultimate last mile for home and enterprise broadband and facilitate the appropriate use of both wired and wireless technologies in IoT, enabling FWA to be applied in more scenarios.

The Second Revolution of Optical Networks: The Strategic and Business Value of FTTR for Carriers

With the right approach, carriers can use FTTR to enable product and service differentiation, overcome competition from OTT players, and boost their brand equity.

China's carriers have deployed or upgraded all access networks with optical fiber over the past decade, representing the first optical-network revolution and laying the foundation for second optical revolution of FTTR.

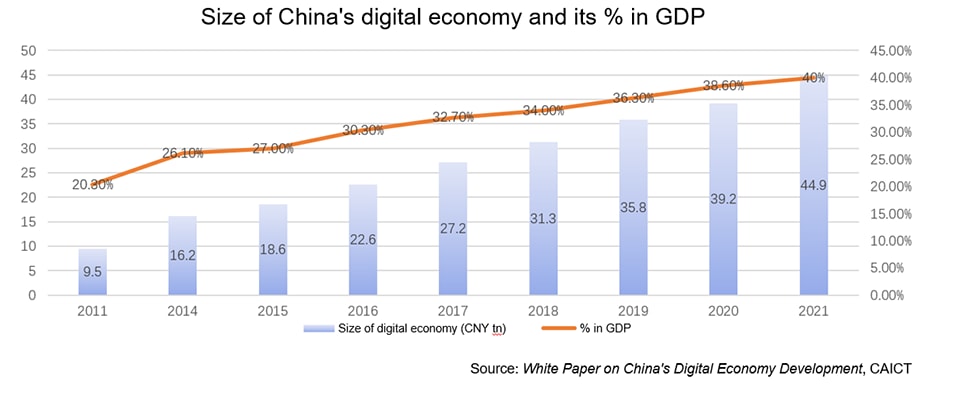

By the end of 2021, China's digital economy had experienced fivefold growth over the preceding decade to reach 44.9 trillion Chinese yuan, transforming the nation into a cyber powerhouse. During that time, the proportion of the digital economy in relation to the national economy doubled from 20% to 40%.

Ⅰ. Strategic value of fiberization

China's “Cyber Powerhouse ”strategy began with fiber broadband. In the industrial policy environment of triple play network convergence, Shanghai Telecom took the lead in proposing the "Metropolitan Optical Network (MONET)" strategy in June 2009, prioritizing FTTH network deployment. Based on the successful practice of Shanghai Telecom, China Telecom launched its "Broadband China ▪ Optical Network City" strategy in February 2011. In 2013, "Broadband China" was upgraded to a national strategy.

By the end of 2021, China had more than 500 million broadband users, 94% of whom were fiber broadband users. Of those, 92% were subscribed to megabit bandwidth, while 35 million were subscribed to gigabit bandwidth. By the second quarter of 2022, the number of gigabit users had jumped to 56 million.

Without fiber, neither fixed nor mobile networks can flourish. Fiberization ratios are key indexes for measuring network development, including the ratios of fiber to the home, fiber to the enterprise, and fiber to the base station.

China's carriers have deployed or upgraded all their access networks with optical fiber over the past decade. The first optical-network revolution laid the foundation for China to become a cyber powerhouse. And over the next decade, the second revolution of optical networks will realize the fiberization of home networks and enterprise LANs with fiber to the room (FTTR). It will achieve the development goal of end-to-end full-fiber networks, and further strengthen the position of the Cyber Powerhouse strategy.

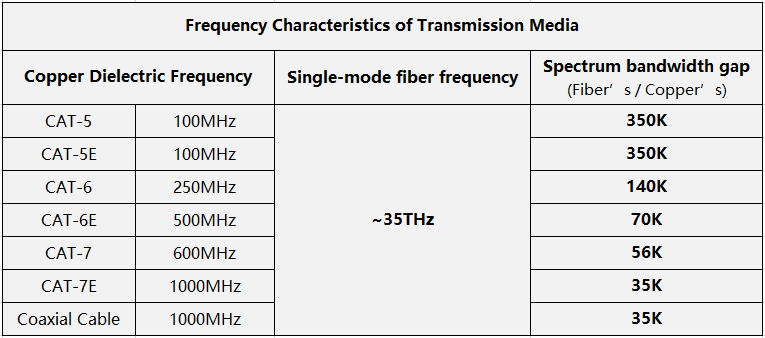

The two basic factors that determine communication bandwidth are the frequency characteristics of the transmission medium, which is the most important parameter, and the corresponding modulation technology. Comparing the frequency characteristics of copper wire and single-mode optical fiber provides many useful insights.

The above table shows that the spectrum capability of fibers can exceed that of copper wire by tens of thousands to hundreds of thousands of times. While the bandwidth potential of copper wires is limited, the potential for fiber is infinite. Due to bandwidth bottlenecks, copper wires need to be upgraded every five to ten years, making network evolution more difficult. In contrast, fiber has a long service life and can be deployed in one go without requiring re-cabling for 30 years. Currently, fiber is the transmission medium that offers the highest bandwidth potential. Compared with copper wires, fiber consumes less energy and is more suitable for achieving green development goals.

Ⅱ. FTTR brings new business value to carriers

From the perspective of carriers, FTTR can bring obvious strategic opportunities in the areas of differentiation, premium quality, and visualization, giving carriers an entry point to home and enterprise LANs. Notably, FTTR is more valuable for SMEs. .

1. Differentiation and Premium Quality

Differentiation is a powerful tool for enterprises to improve competitiveness and achieve sustainable development.

Differentiation in terms of products can maximize value and provide benefits from market segmentation. Differentiation through competition can include different quality offerings at the same price or different prices at the same quality.

In the government and enterprise markets over the past two decades, Chinese carriers have recognized the competitive advantages brought by differentiation in terms of tariffs, quality, bandwidth, protection and recovery, latency, visualization, product differentiation of other value-added services, and differentiation in pre-sale, in-sale, and post-sale capabilities and levels. However, in the home broadband market, much space still exists for differentiation. Current home broadband packages focus on differentiated tariffs and bandwidths, but do not take advantage of quality differences. With the homogeneous competition of home broadband, quality and service differentiation will become more important for home broadband. As one executive of a Chinese carrier noted, there are nearly 300,000 high-income individuals in the city where he lives. They are the potential customers of Home FTTR and can help enhance the brand equity of the carrier.

Brand equity is one of an enterprise ’s most important assets and is in turn intrinsically linked to the perception of premium quality. As the FTTH user market of Chinese carriers is approaching saturation, home Wi-Fi networking has become a mainstream method for carriers to enhance customer loyalty and improve competitiveness. Compared with traditional Ethernet cable Wi-Fi, FTTR-based optical cable Wi-Fi delivers superior home-network quality. People perceive optical fiber as representing premium quality, which is the ultimate goal of home networks.

For tier one fixed carriers, FTTR can build up brand equity for their broadband offerings. For tier two and tier three fixed carriers, FTTR can be used as an effective means to overtake competitors. The window of opportunity is determined by differentiated competitive ability. Whoever deploys FTTR first will attract users first, especially high-end users. Opportunity knocks but once.

The carrier I worked at for 30 years launched the "Metropolitan Optical Net" project in 2009 and the "World's First Gigabit City" project in 2016. Were these projects all driven by service demand? Not entirely. At the time, they were oriented not only to service demand, but also to competition. This carrier took the lead in deploying its optical network in order to seize the opportunity of service development, consolidate infrastructure network capabilities, raise the competition threshold, and build up its broadband brand equity. Some people were against the projects at the time, because they were not underpinned by business requirements. But, now they applaud the wise strategic decision. Pipes are always the foundation of carriers, whether fixed or mobile. Numerous successes and failures in history have proven that in the Internet era, bandwidth and latency always represent core competitiveness.

Demand can be stimulated and created. It can be driven by business, competition, technology, investment, or policies. And more recently, even the pandemic has proven to be a driver. Are Chinese 5G and Gigabit optical networks driven by business requirements? In my opinion, they are the sum of the above-mentioned driving forces.

2. Visualization

Compared with traditional Ethernet cable Wi-Fi, FTTR requires communication protocols between the master gateway and slave gateways, which brings visualization to carriers and end-users.

Visualization for carriers: Through NCE-FAN carriers can obtain various fault data from home networks. Through big data analysis, they can remotely guide end users to resolve a large number of faults, reducing O &M costs caused by unnecessary onsite visits. Based on AI analysis of Internet surfing characteristics, carriers can market AI-based application acceleration packages to specified user groups and benefit from providing value-added services (distance education and cloud games, and so on).

Visualization for end users gives controllability of certain functions: Users can use an app to view connection topology, connected terminals, connection types, and connection status on their home network; verify the installation and maintenance quality of carriers; and control the online time and content of various terminals, including games, videos, office work, social networking, and payments. In addition, they can detect the network, device, interference, coverage, configuration, and load status, greatly improving the service experience for end users.

Making, not saving, money is the goal. To make money, expenditure is required. So, reducing procurement costs should not be at the expense of network and service performance and functions, nor should we focus only on procurement costs and ignore O &M costs. Procurement costs are one-off, while O &M costs are long-term and need to be considered systematically.

3. Consolidate the home DICT foundation

On home networks, carriers have advantages in gateway connections and door-to-door services. Carriers compete with OTTs for the entrance of home network connections, while carriers compete with each other in installation and maintenance capabilities, which require better O &M teams and systems.

The home network connection entrance is a core advantage possessed by carriers. However, traditional home Wi-Fi networking solutions, such as ethernet cables, PLCs, and Wi-Fi relays, are used. OTT devices have their own smart home solution ecosystem based on home routers. Therefore, carriers' home network connection entrances are often bypassed by OTT devices, so the advantages of the home gateway cannot be fully utilized. FTTR can completely change this situation. Because communications-specific technology is used between the master and slave FTTR gateways, OTT home routers are not an option. This enables carriers to control access to home network connections through the master gateway of FTTR, consolidating the foundation of home DICT.

Network connectivity is a key advantage of carriers, including Wi-Fi networking, which ensures user experience and door-to-door service awareness. OTT is good at service applications, for example, using a smart speaker at the entrance to implement service control with human-machine interaction. Professionals handling professional issues creates a reasonable and sustainable ecosystem.

4. ToB is more valuable

Historically, one carrier provided a large number of enterprise gateways for small and micro enterprise customers. The purchase price of an enterprise gateway is at least five times higher than the price of a home gateway, but most of these were used in bridged mode. The carrier spent large sums on enterprise gateways, but they did not get any more business opportunities through bridged mode. The reason is that carriers do not provide perfect Wi-Fi networking solutions for enterprises, with the market in fact occupied by third-party ICT integrators.

ToB is more valuable. The FTTR-SME can make full use of the resource advantages of carriers ’installation and maintenance services. Through a package solution including cabling, the FTTR-SME can help carriers extend from WAN to LAN and solve the problems of wired and wireless broadband access and providing internal network connections for enterprise customers. Expanding sales scope from a leased line of Internet to enterprise Wi-Fi networking of Intranet services can expand the market space, improve user experience, and enhance customer loyalty. Moreover, carriers' cloud-network synergy resource advantages can be leveraged to meet the cloud migration requirements of enterprise digital transformation, bringing new opportunities for DICT service development.

The home network and SME network are not simple connections of various terminals. They are also a network that needs to be visible, manageable, and maintainable. The FTTR package solution covers not only the gateway itself, but the entire SME and home LAN. Compared with traditional AC+AP and Mesh Wi-Fi networking, FTTR has unmatched advantages in anti-interference capability, roaming handover delay, bandwidth capability, user experience, visibility, manageability, and O &M.

FTTR in China is developing on a large scale. By the first half of 2022, the three major carriers in China had attracted 400,000 FTTR subscribers, a five-fold increase over the second half of 2021. By the end of 2022, this is expected to exceed 2 million. As well as China, more than 20 carriers in West Europe, Asia Pacific, Latin America, and Middle East are very optimistic about the FTTR development direction and are actively conducting pilots, with some specifying their FTTR strategic development goals.

The Second Revolution of Optical Networks: The Large-scale Development of FTTR

China's optical FTTR market is thriving, so what can policy makers and global carriers take from its best practices?

The FTTR market consists of two major segments: The first is indoor optical cable installation provided by construction companies and interior design companies. The second is indoor optical cable installation provided by carriers.

1. The market segment of indoor optical cable installation provided by construction companies and interior design companies

This market segment concerns newly built houses and apartments and pre-owned houses and apartments.

1) Newly built houses and apartments

Newly built houses and apartments mainly involve real estate developers. Government departments release codes or technical white papers for communications facilities. At the national level, responsibility lies with the Ministry of Housing and Construction and the Ministry of Industry and Information Technology (MIIT), and at the local government level, the Administration of Housing and Construction and Communication Administration is responsible. China has positioned the construction of residential buildings with communications facilities as a basic necessity for work and life, much the same as water, electricity and natural gas.

As early as 2012, China's Ministry of Housing and Construction released the Code for Optical Fiber to the Home Communication Facilities in Residential Areas and Residential Buildings, which stipulates that in new residential buildings, fiber should replace Ethernet cables and telephone lines and be deployed to the entrance of homes. This code controls telecom network construction standards from the source. It has led the whole ecosystem and industry, and promoted the rapid development of FTTH in China.

If a previous code still defines that Ethernet cable and voice cables must be installed at home entrances, then multiple access modes will exist for fixed broadband networks such as FTTB/C and HFC. This will inevitably delay the progress of developing optical networks in China.

Today, China's 14th Five-Year Plan and the 2021 government work report have set out requirements for the development of 5G and gigabit optical networks, aiming to develop China into a “Cyber Powerhouse ”and accelerate the digital economy. On March 24, 2021, the Ministry of Industry and Information Technology (MIIT) released the Dual-Gigabit Action Plan to promote home-cabling and optimize gigabit wireless LAN networking. On April 6, 2021, 16 ministries and commissions in China jointly released Guidance on Accelerating the Development of Digital Homes and Improving Residential Quality, encouraging the construction of fiber-to-the-room and fiber-to-the-desktop, and focusing on improving the quality of residential indoor networks. As a result, government departments in Fujian, Shandong, and Yunnan in China have developed building communication standards for FTTR. They specify that indoor cabling should adopt fiber instead of Ethernet cables. The Fujian standard is the Building Communication Infrastructure Construction Standard, which was released on August 1, 2021. The Shandong standard is the Technical Standard for Intelligent Building Engineering, which was released on April 1, 2022. The Yunnan standard is the Construction Standard for Fiber-to-the-Home Communication and Cable Television Facilities in Residential and Commercial Buildings, which has been drafted for consultation.

To guide the development of the ecosystem and industry and to improve the customer experience, there are three key points for formulating FTTR standards for communication facilities inside buildings:

First, Ethernet cables are no longer considered for indoor cabling, because they would affect the development of end-to-end full-fiber networks.

Second, fiber electric composite cables are recommended for power over fiber. If traditional flat fiber is used, fiber-connected Wi-Fi devices need to be connected to an external power supply, which would impact the decor of houses and user experience.

Third, the demarcation between real estate developers and carriers needs to be clarified. The home information box, A86 panel box, and fiber electric composite cables are constructed and installed by developers. The master FTTR gateway, slave FTTR gateways, and optical splitter are installed, provisioned, and maintained by a carrier selected by the end user.

2) Pre-owned houses and apartments

More details about this category are provided in “The indoor FTTR cabling code of Communication Engineering for New Residential Buildings ”issued by the national, provincial, or municipal governments.

For end-users, carriers need to develop a “Home Decoration Cabling Manual ”for FTTR and a corresponding video. The manual and video should be available in the carrier's service center so that end users can view the video and obtain the manual at any time. Online business halls should also play the video.

The interior design industry and mainstream interior design companies should conduct communication activities and hold forums to discuss and develop scenario-based FTTR solutions.

2. The market segment of indoor optical cable installation provided by carriers

1)Top executive leadership

As the second revolution of optical networks, FTTR can build up its brand image only when it is scaled up. This involves cost budgeting, package design, marketing channels, installation and maintenance capabilities, business processes, and digital capabilities. It involves multiple departments and requires strategic determination and roadmap from top managers.

2) Standardization

Only standardization can achieve large scale and premium quality. For standardization work involving large-scale FTTR deployment, carriers need to formulate the following standards:

Cable technical specifications: encourage industry associations to formulate technical standards for fiber electric composite cables and connection components to promote ecological and industrial construction.

FTTR installation procedures: formulate a scenario-based installation process, installation standards, and terminal selection. Terminal types include A86 panels, desktop, and ceiling-mounted terminals.

Training materials: develop systematic training materials.

3) Marketing capabilities

Public publicity: produce easy-to-understand FTTR advertorials and videos, and publicize and broadcast them in the mass media.

Package design: design premium, differentiated, and modular packages. Carriers should increase the FTTR sales commission for marketing staff to motivate FTTR sales.

Five-star business hall: set up the FTTR service-experience environment that users can experience onsite.

Expand sales channels: includes business halls, online sales channels, ecosystem partners, and installation and maintenance engineers and so on.

4) Installation and maintenance capabilities

Installation and maintenance capabilities sit at the core of competition and the sustainable development of fixed network services, especially in the context of home DICT development. The installation of FTTR is more complex than FTTH. Therefore, the bottleneck in large-scale FTTR deployment rests with installation and maintenance capabilities.

There is a need to implement a series of measures:

Set up an engineer team for VIP users: This team would comprise a certain number of engineers and professionals with high-level skills to expand the team of smart home engineers and provide differentiated service levels and capabilities.

Increase the salary of installation and maintenance engineers: There is still a salary gap between installation and maintenance engineer and those responsible for delivery. The low income of skilled people cannot reflect the value of their skills, and is not conducive to retaining skilled talent.

Strengthen training in installation and maintenance: Set up an FTTR training base to carry out installation and maintenance training, examinations, assessments, and certification based on the home DICT service.

5)Digitalization capabilities

Digital capabilities of "planning, acceptance, and maintenance" must be built to make FTTR Wi-Fi visible, manageable, and controllable so as to improve user experience and service efficiency.

“Planning ”: Simulation planning for visualized effect, including site survey, requirement collection, device installation location planning, effect simulation, and user confirmation.

“Acceptance ”: Three-step acceptance ensures quality. Network acceptance includes ODN, devices, and connections topology. Service acceptance includes Wi-Fi speed tests, IPTV, and Internet access. User confirmation is involved in acceptance.

“Maintenance ”: includes remote demarcation, intelligent fault diagnosis, and the automatic output of quality evaluation reports.

6) Others

Construction tools: Further optimize and improve construction tools and processes.

FTTR service exhibition hall: Set up a service exhibition hall for external ecosystem partners based on home &SME DICT services to improve the perception of FTTR quality for governments, industries, society, and the public.

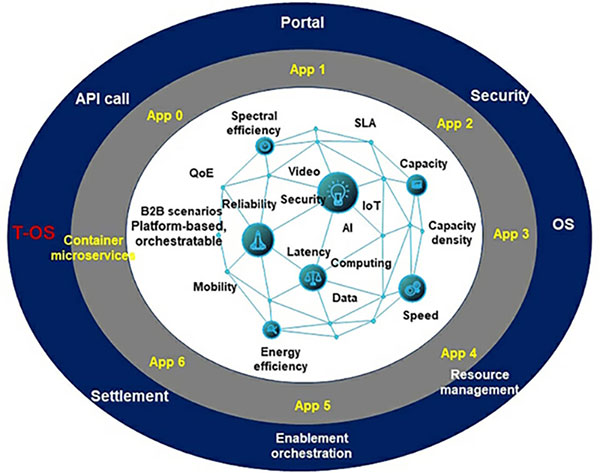

Innovation Strategies for B2B Telecom Solutions

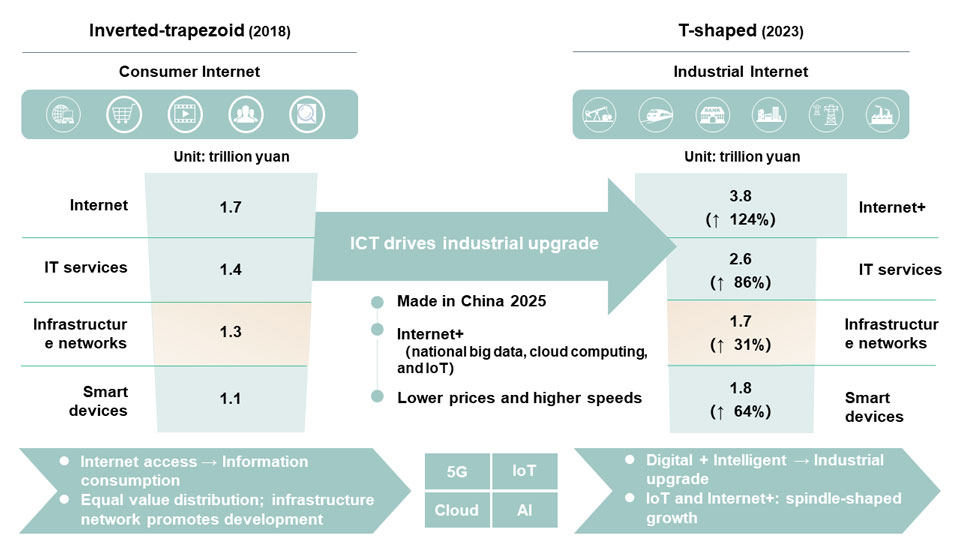

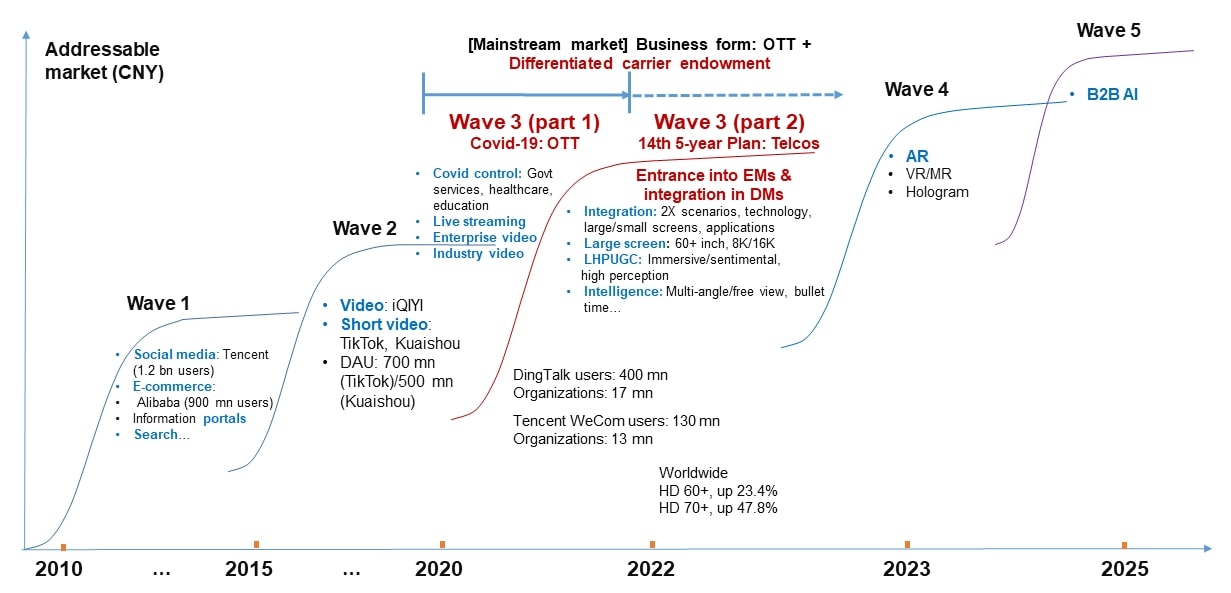

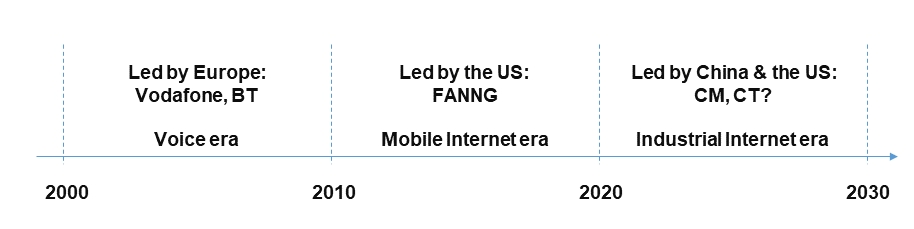

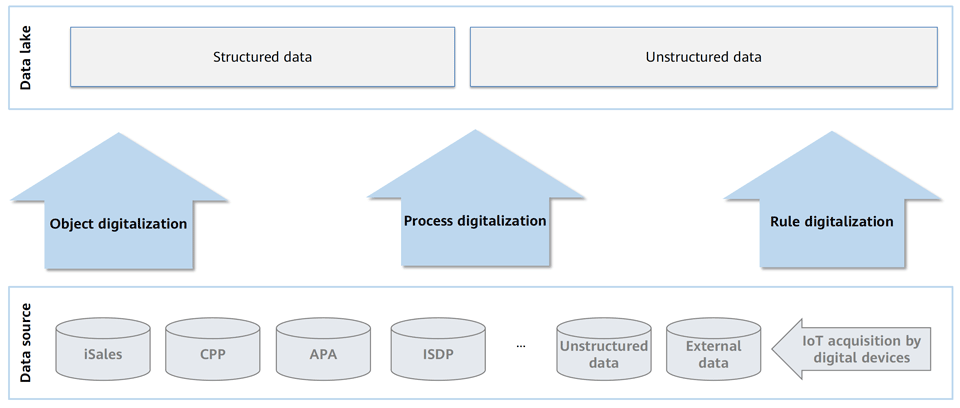

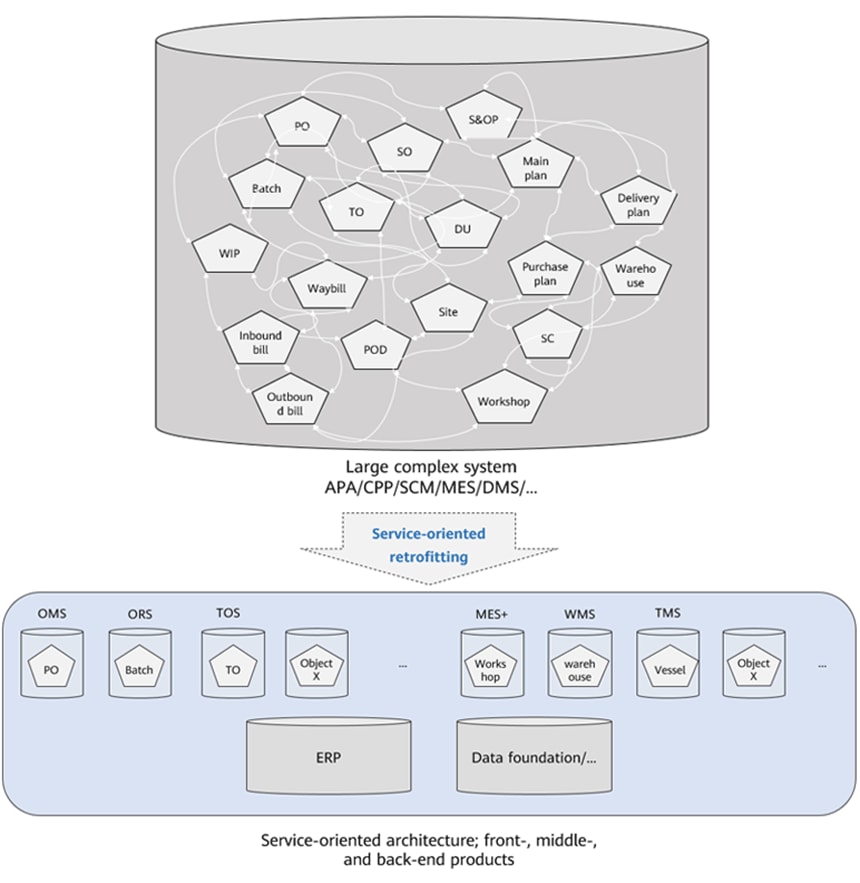

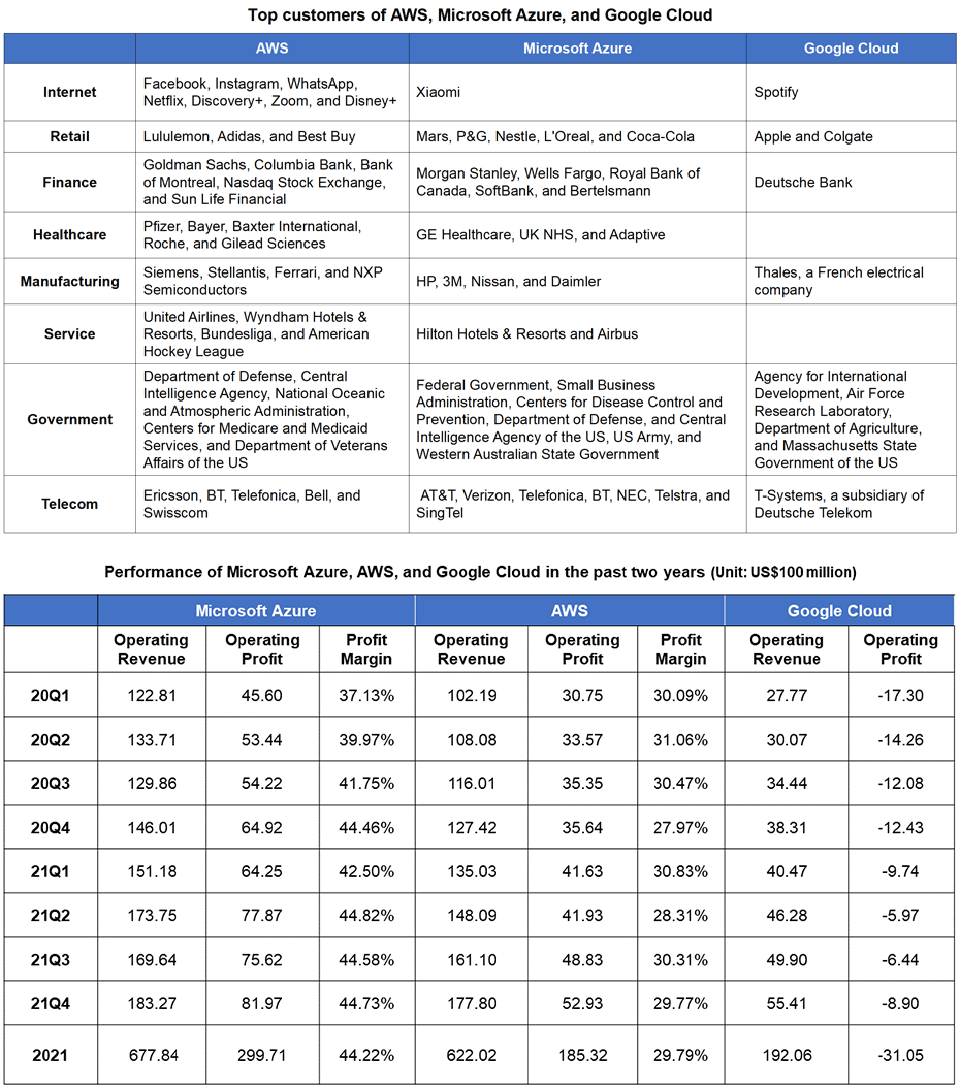

2020 to 2030 will see the Industrial Internet thrive. Leading global carriers must innovate new intelligent, digital services, transform their business models in the new arena and achieve new growth in vertical industries.

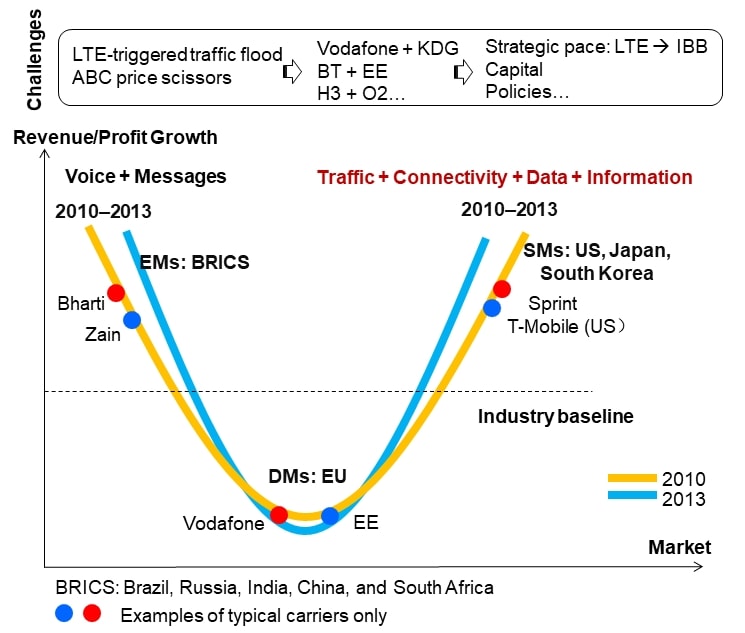

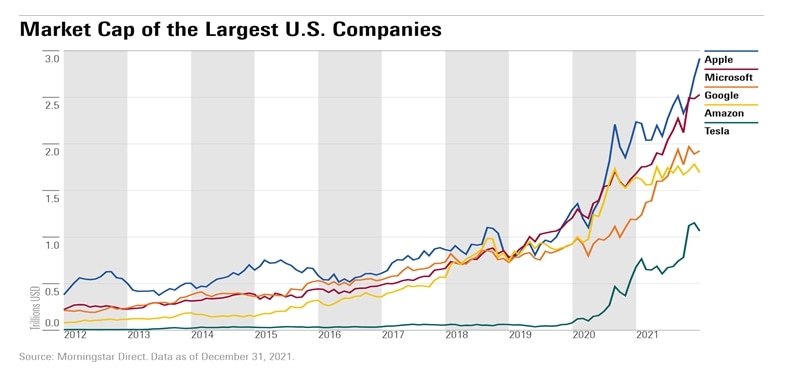

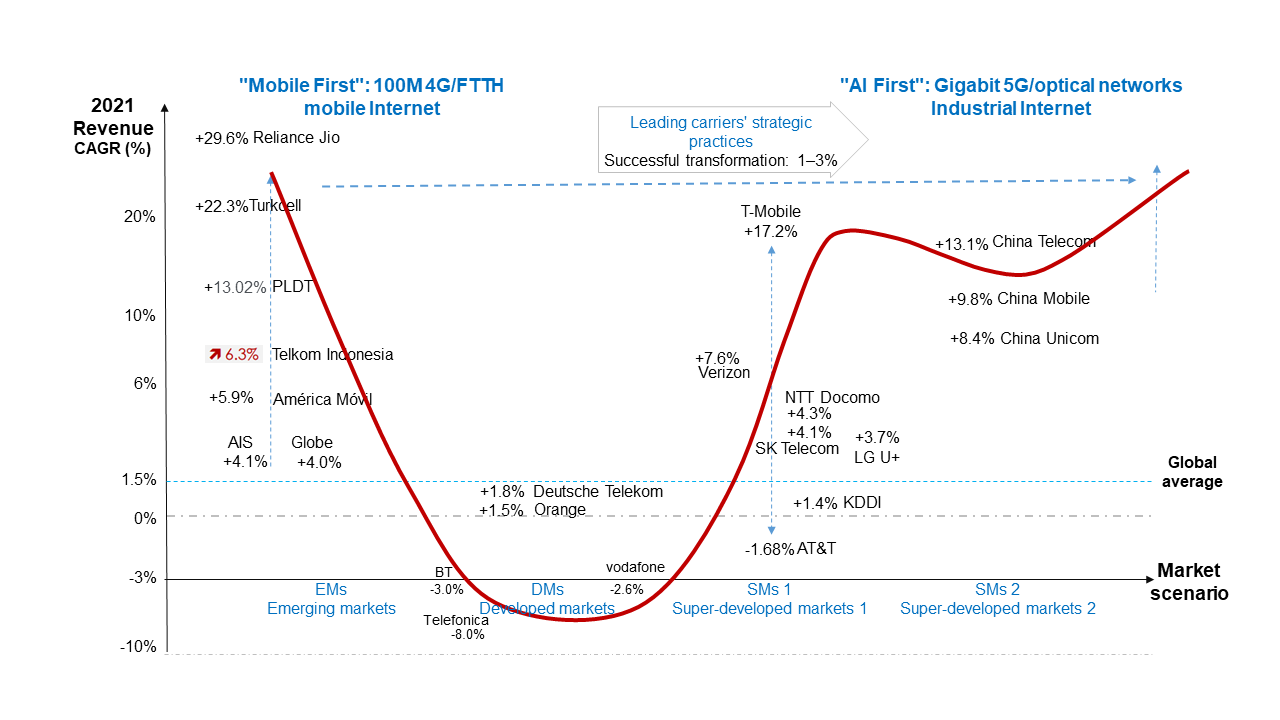

Internet companies have thrived during the decade of the mobile Internet. Microsoft, Apple, Google, and Amazon had a combined value of US$6 trillion in 2021, and Apple was valued at US$3 trillion in 2022. In contrast, the telecom industry experienced a period of decline, with its growth rate dropping to 2%–3%. GSMA predicts that if carriers continue the "dumb pipe" business model, the growth rate will be only 1.5% between 2021 and 2027, and that the market space will not exceed US$2 trillion in 2027, despite a booming Industrial Internet.

What should the telecom industry do? The answer is transformation.

The Industrial Internet: A blue ocean with challenges

New technologies like 5G, cloud, big data, artificial intelligence, and IoT are creating a new wave of Industrial Internet innovation and development. Driven by national digital economy strategies, the Industrial Internet will become the biggest blue ocean for new growth.

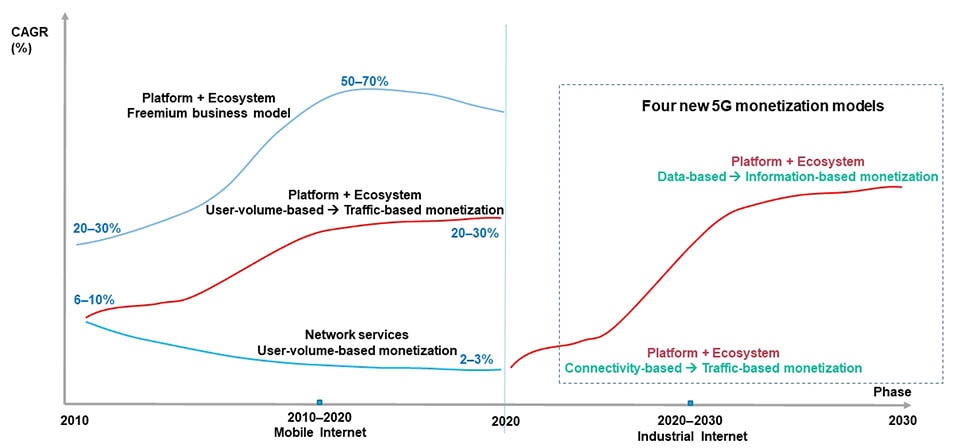

Figure 1: Industrial Internet market space analysis

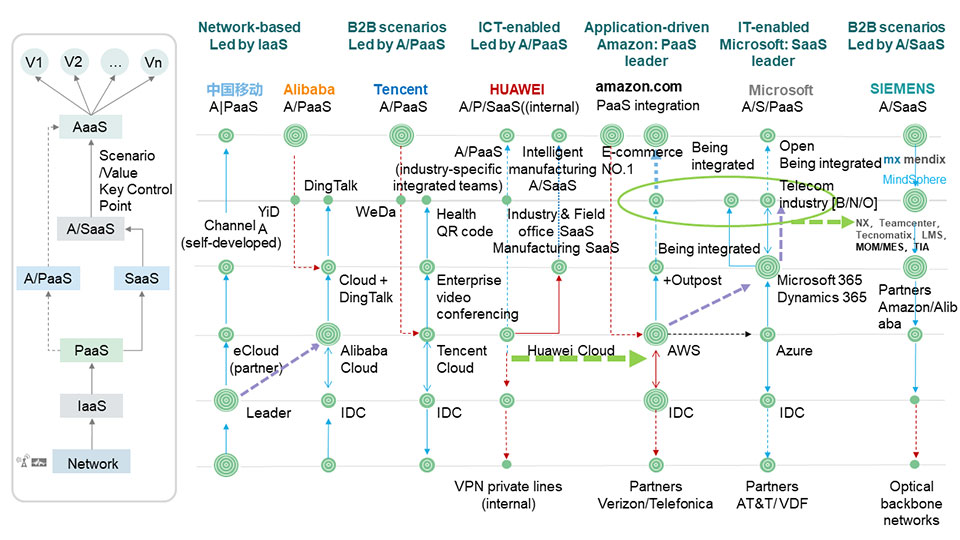

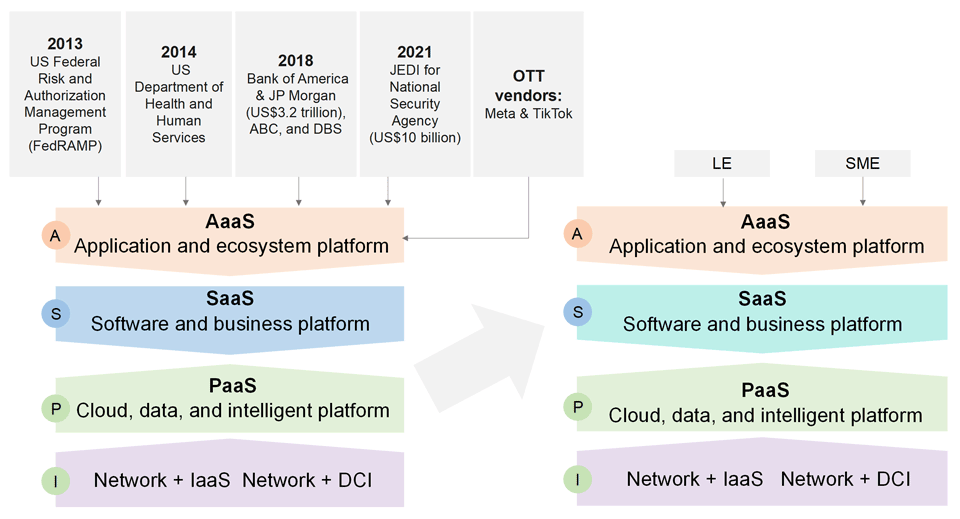

In the Industrial Internet era, carriers must draw from their experience and lessons learned in the mobile Internet era. They should build optimal gigabit networks and high-quality connections, actively extend their service capabilities to vertical industry ecosystems, and develop industry solutions through open cooperation and innovation. This is the only way they can create new business models and new value in new domains. During the past decade, leaders of the information industry have entered the strategically important B2B industry. Global carriers such as AT &T, Telefonica, and Vodafone; Chinese carriers, including China Mobile, China Telecom, and China Unicom; and Internet companies like Amazon and Alibaba have chosen between the strategies of integration or being integrated. They have also forged partnerships. Some of these attempts have succeeded, some have failed.

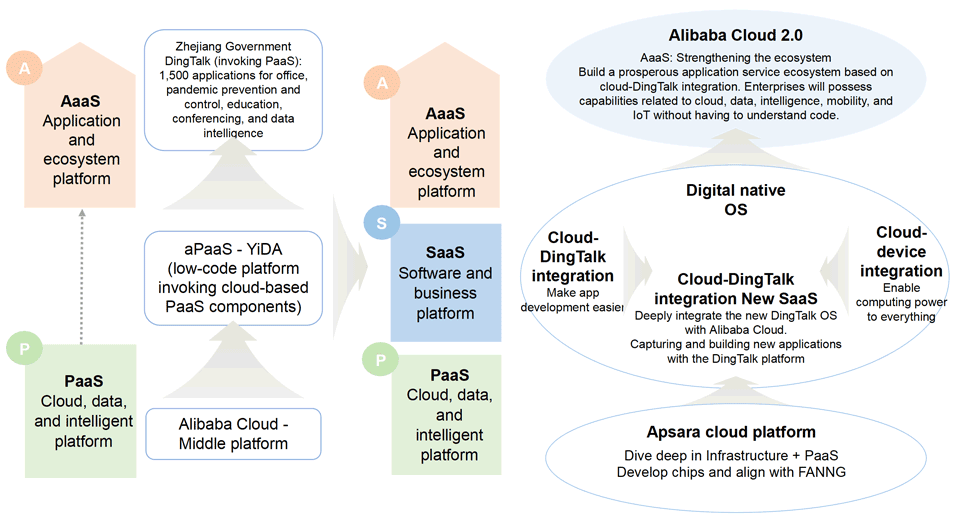

In October 2016, Alibaba ’s Jack Ma proposed the five “new ”strategies of new retail, new finance, new manufacturing, new technology, and new energy. He hoped to make use of middle platforms to quickly integrate and break through industry markets. But, in fact, these new domains have been fed by Alibaba's core e-commerce business. This reveals the challenges facing B2B innovation. Huawei has also adjusted its B2B market strategy from integration and being integrated to establishing integrated teams. Currently, Huawei is still exploring its B2B strategy as it moves forward.

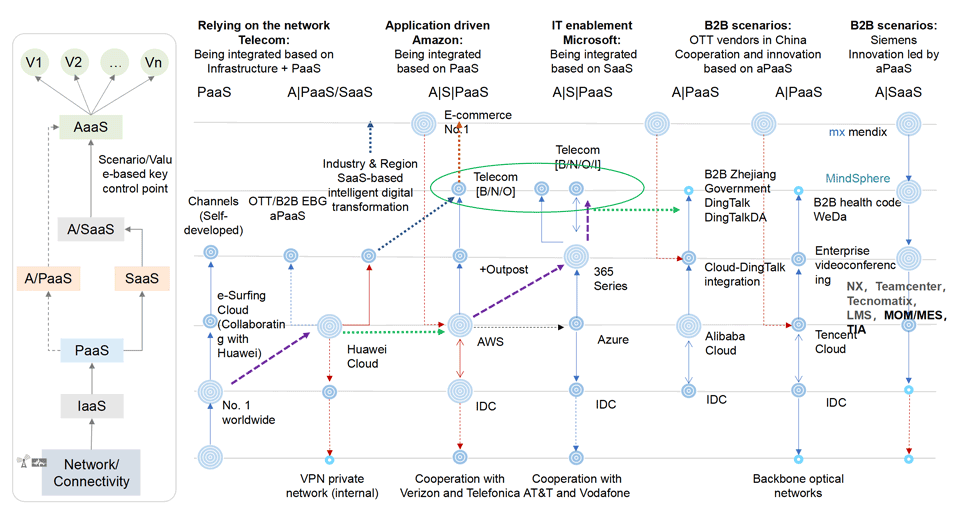

Figure 2: A/SaaS solution innovation strategy in the B2B domain

Carriers lack the ability to develop integrated solutions for core B2B markets and have not established differentiators in services. A lack of strategic control points leads to unclear profit models, making it difficult for B2B business to support sustainable development and growth.

What is a way out for carriers in the B2B market?

Four B2B market transformation and breakthrough strategies

We have proposed four B2B market transformation and breakthrough strategies by considering B2B business from a global and industry perspective. These strategies assess carriers' success in terms of business scale and profits.

Model 1: PaaS integration

E-commerce has driven the cloud innovation and iteration of AWS, allowing Amazon to lead the world in PaaS performance, efficiency, cost, security, and openness. Governments, banks, and top OTT players have all selected AWS for cloudification and digitalization. With strong capabilities in application as a service (AaaS) and SaaS, top enterprises, government agencies, and OTT players in the US have led the integration of Amazon's PaaS system. This helped streamline the industry value chain and enabled the iteration and operations of applications and services. The secret to Amazon's high profitability from PaaS lies in the aggregation and contribution of top customers, which creates a virtuous cycle for its B2B business.

Model 2: SaaS integration

While trailing Amazon in the PaaS space, Microsoft identified market demand and opportunities for SaaS, integrating Azure into its own software systems such as Windows, Dynamics 365, Office 365, and LinkedIn. This helped Microsoft become a leader in enterprise SaaS solutions and rapidly expand its enterprise market. For the industry market, Microsoft built the Power Platform based on SaaS, on which industry customers can develop applications from the top down, create new B2B solutions by integrating enterprise SaaS, and make breakthroughs in AaaS.

Model 3: Innovative A/PaaS model

Alibaba's Zhejiang e-government DingTalk team and Huawei's integrated teams leveraged their strong PaaS capabilities to enter the B2B market. They developed innovative scenario-based applications, including video surveillance, drones, and AR applications, that relied on cloud, big data, and AI PaaS platforms, creating new business models. The A/PaaS model simply connects the SaaS systems of industries rather than overhauling these systems. Due to limited value to the scenarios it supports, this model is only an innovative choice for markets that lack software autonomy, as it does not deal with core software. The A/PaaS model can be used only in limited scenarios and lacks core competitiveness.

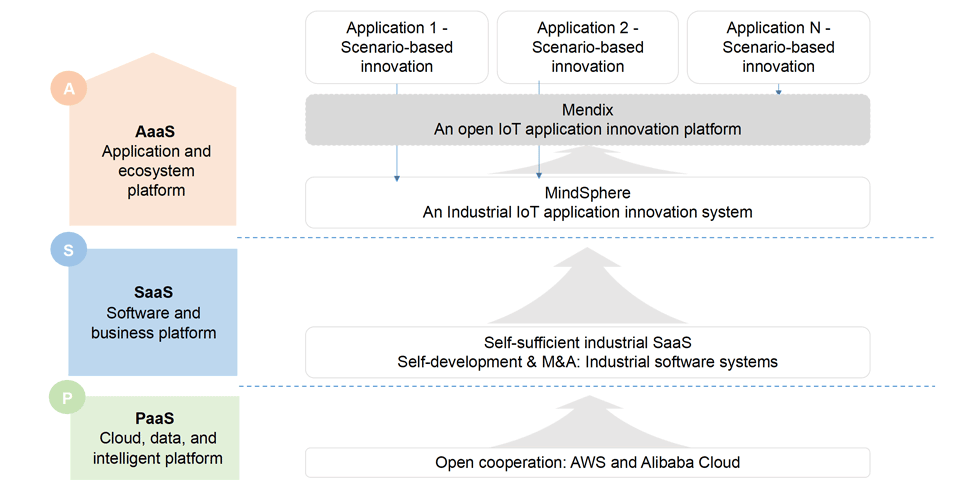

Model 4: Innovative A/SaaS solution from inside out and top down

Siemens' intelligent manufacturing solution is an innovation driven by IoT application scenarios in the manufacturing industry. Siemens has a powerful industrial software SaaS platform and capabilities. To integrate data technologies and new IoT technologies and transition into digital and intelligent manufacturing, Siemens developed Mindsphere, an IoT application innovation platform. With Mindsphere, different IoT devices, including intelligent control robots, robotic arms, AGVs, and sensors, can be developed to build AaaS platform capabilities. Siemens also used Mindsphere to develop Mendix, a low-code IoT application development platform that helps partners develop customized applications based on factory scenarios and foster an application environment. Siemens' digital and intelligent transformation strategy is to identify and focus on high-value IoT application scenarios. Based on technology maturity assessments, Siemens focused on innovative vertical solutions, developed new commercially replicable business models, and extended applications to other industries horizontally. The scenario-driven, value-oriented strategy helped Siemens surpass GE to become a role model of digital and intelligent transformation in the Industrial Internet era.

Huawei implemented a similar digital and intelligent transformation based on its advanced manufacturing system.

These success stories suggest that the key to B2B market transformations and breakthroughs is connecting vertical ecosystems, developing new services and applications that deliver value, and building A/SaaS solutions through open iteration and innovation with ecosystem partners.

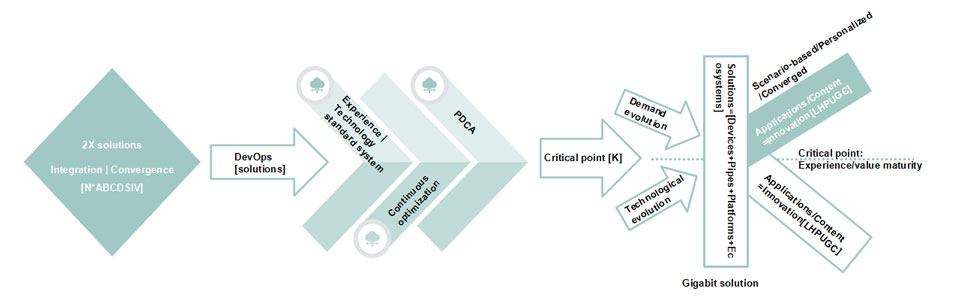

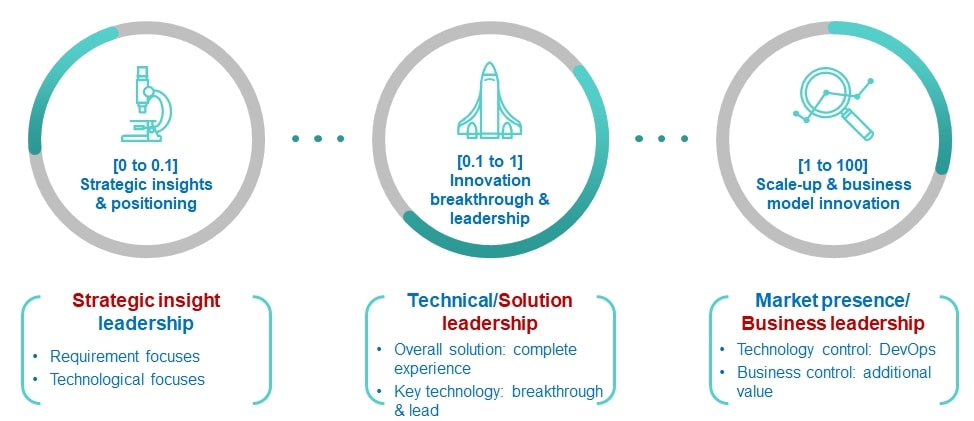

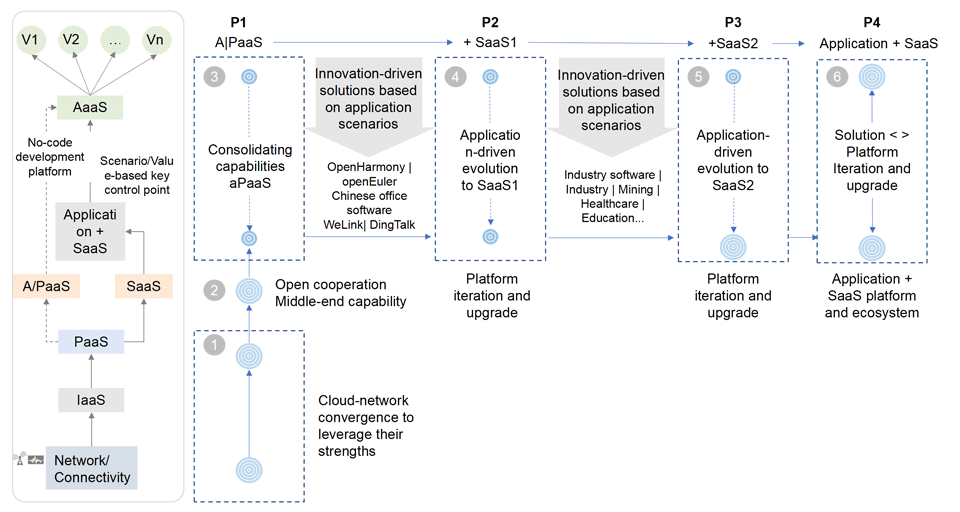

Upgrading innovation from products to solutions

Major global carriers have been working in the B2B business for more than 10 years. Carriers in China, the US, and Europe mainly provide new products and technologies, such as networks, cloud, big data, IoT, artificial intelligence, enterprise private lines, and videoconferencing, as part of their integrated solutions. This model has helped carriers achieve rapid market growth in the early stages of technology deployment. However, as this model becomes more fragmented, the industry will face challenges to turn a profit. Carriers must upgrade B2B solutions, break through the critical point of B2B market value, and go beyond connectivity to achieve profitable business at scale.

To upgrade the B2B solution strategy, carriers need to build on their IaaS strengths in networks, cloud, data, security, and localized resources, and identify strategic businesses in the B2B market. They should also predict market demand and the maturity of opportunities; seek ecosystem partners, including leaders at the AaaS, SaaS, and PaaS layers; and choose an effective cooperation model between integration and being integrated so as to connect the vertical ecosystems of I-P-S-A solutions.

If carriers are integrators, they cannot provide competitive solutions due to a lack of expertise and control over vertical industries. If carriers want to have their solutions integrated as part of their overall offerings, then no one will be integrators due to a lack of leading application and software players in China's ICT industry.

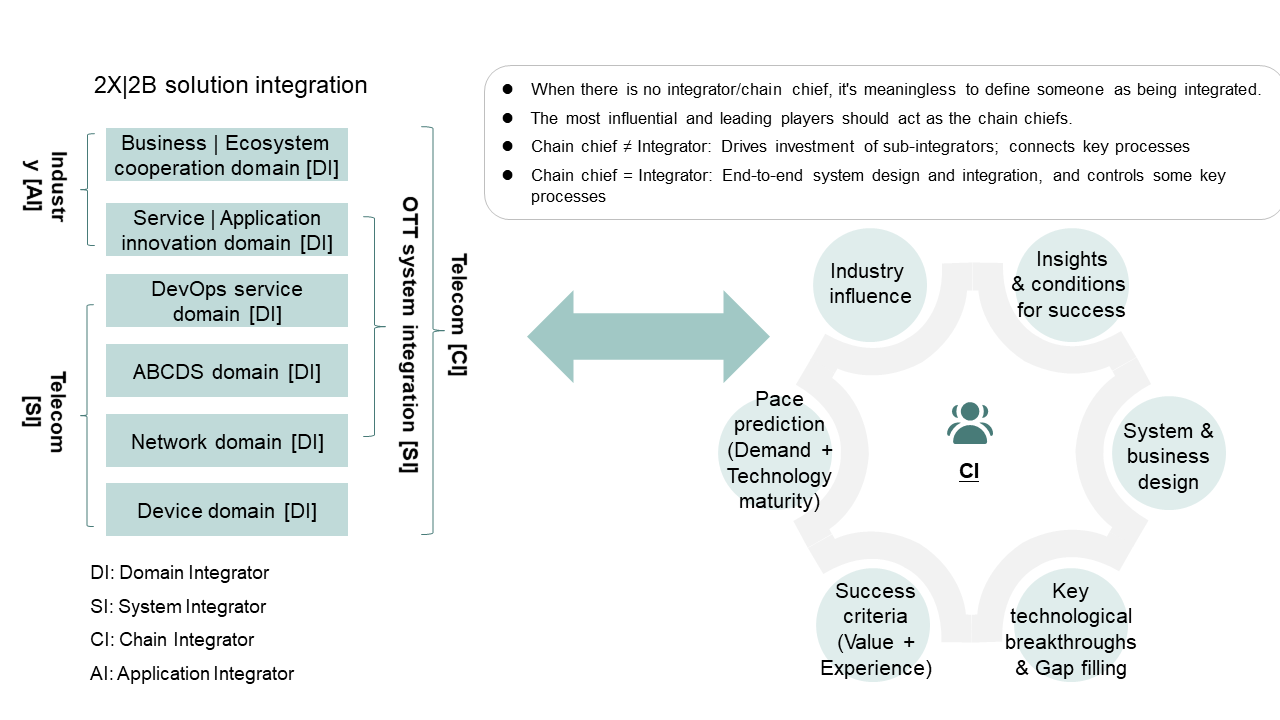

Figure 3: The "value chain chief" model enables B2B solution integration, innovation, and breakthroughs

As industry development hit new bottlenecks, the telecom industry recommended that carriers or industry leaders serve as "value chain chiefs", as the industry lacks integrators with leadership and end-to-end technical capabilities. This model will help form industry alliances to explore integration standards for solution architectures, applications, and modules. Following these standards, industry players can innovate and develop solutions on their own, with their solutions integrated to adapt to different scenarios under the leadership of the chief. This is like how different compartments of a bullet train work, as shown in Figure 3.

After breakthroughs are made, the chief can replicate end-to-end solution integration capabilities and transform into a solution integrator in the B2B industry, so as to achieve large-scale business expansion and create larger space for growth.

B2B solution innovation is a process of trial and error in different scenarios. The success of solutions should be measured by the critical point of value. The industry follows the "K-shaped" rule of value, as shown in Figure 4. The rule states that if the value of new business forms exceeds the critical point in the K-shaped model, they will have higher returns and more growth opportunities. If not, they will be rejected by the market. Carriers must select the right strategic direction and industries, and continuously iterate, optimize, and upgrade solutions to approach and even exceed the critical point of value. Carriers must possess innovation capabilities and a strong will to win.

Figure 4: Scenario-based B2B solution iteration and breakthrough of the critical point of value

Back to being value-oriented

The B2B market is essential for the telecom industry. To achieve success, the industry must generate more value for customers through innovation to optimize and upgrade previous businesses and replace them at scale.

While continuously pushing the limits of underlying technologies, carriers should carry out scenario-based, value-driven innovation, and identify key industry customers and new business requirements. They should serve as "value chain chiefs" or integrators to bring together the strongest partners along vertical ecosystems, and focus on high-value applications to develop innovative solutions that integrate devices, pipes, clouds, intelligent technologies, and security. This solution-based innovation model goes beyond the current platform-based innovation model by focusing on new applications, solutions, and platforms.

Carriers must refocus on market and customer needs, and identify strategic opportunities and the maturity of industries in different scenarios. Building on their strengths, carriers should establish cooperation models that adapt to industry development status in the vertical domain, and voluntarily act as the "value chain chief" to achieve business expansion at scale and bigger growth.

Carrier Strategies for Driving Returns from Fixed Gigabit Networks

Despite a surge in users, the penetration rate of gigabit broadband subscribers in China is less than 10%. How can carriers accelerate large-scale commercial deployment and industry growth?

1. Fixed gigabit networks: A new area of competition

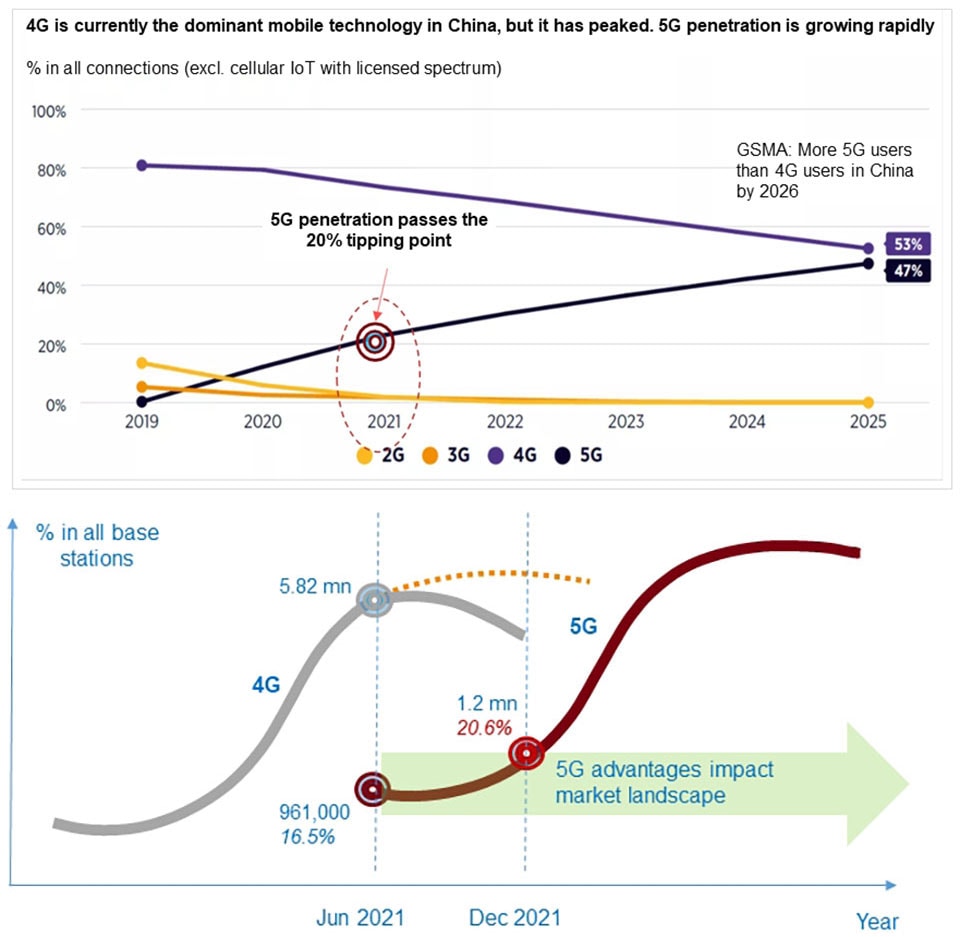

In China, the penetration rate of both 100M 4G and fixed networks has exceeded 98%, indicating saturated demand. However, the penetration rate of fixed gigabit networks still has much room for improvement.

By the end of 2021, China had about 520 million fixed network users, of which less than 15 million were gigabit network users, less than 3% of the total. When the number of gigabit network users soared to 40 million, the penetration rate of gigabit networks in China was just 7%. With 5G's penetration rate now over 20%, the penetration rate of fixed gigabit networks represents a strategic breakthrough point.

China Mobile continues its leadership in 4G mobile gigabit networks. Its 5G market share exceeds 50%, much higher than other carriers. China Telecom and China Unicom have formed a defensive posture in 5G through the collaborative construction and sharing of sites.

If China Mobile works to increase its investment in fixed gigabit networks, it can secure its dominance in fixed networks. Similarly, if China Telecom and China Unicom make breakthroughs in fixed gigabit networks, they can increase their market shares, which are currently 20% to 30%, and challenge the dominance of China Mobile. The two carriers can collaborate to change the entire gigabit market landscape using the 5G market as leverage.

2. Gigabit application planning: 3 flows drive 4 use cases

To change the current market landscape through fixed gigabit networks, carriers must identify the core value-based needs of the market and customers; streamline strategic application planning; and drive solutions across the device, pipe, cloud, security, and ecosystem domains through collaborative innovation. Carriers can only make breakthroughs by first introducing products into the market, then leveraging applications to increase traffic and driving network and platform development with traffic. This will form a virtuous development cycle while ensuring closed-loop business development.

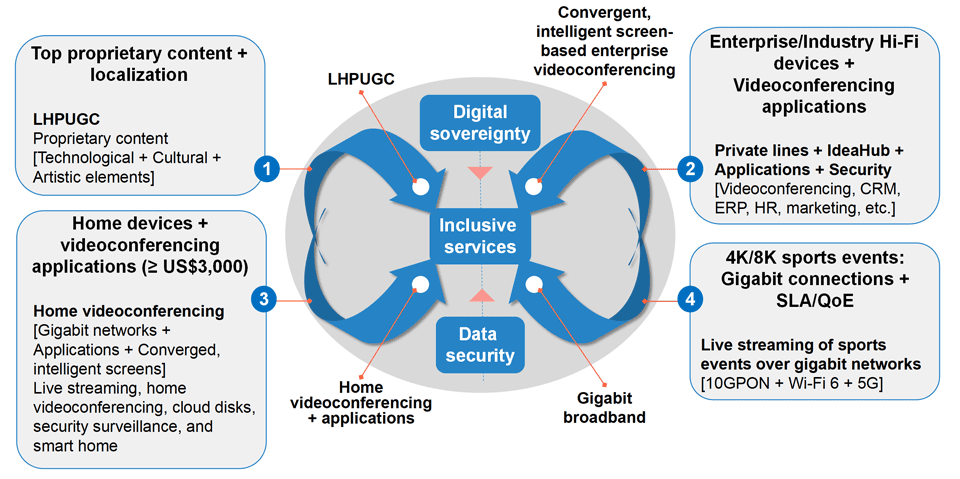

Figure 1: Four strategic use cases that drive gigabit network development

In the mobile Internet era, user flow, data flow, and capital flow are used to identify major market development opportunities and planning applications. User flow reflects the perception of value, data flow represents business stickiness, and capital flow determines growth and profitability. However, Chinese carriers, which are at the forefront of the gigabit network industry worldwide, need to gain insights into incremental users, traffic, and value in the market, and plan for the four use cases in the Chinese market:

LHPUGC new videos: Traditional video companies are making innovative videos with new technologies in response to value-based market demands. These companies are integrating technical, artistic, and cultural elements to create localized new videos with PUGC attributes.

For example, top artists integrated different elements and used XR video technologies to create "Guardian Warriors of Longmen", "Night Banquet in the Tang Dynasty", and "Pray" for Henan TV, and "The Divine Damsel of Devastation" for the game Genshin Impact. These works have put the spotlight on the rich potential of cultural history, winning critical acclaim, going viral as soon as they were released, and topping search rankings.

Convergent, intelligent enterprise communication applications: Due to the pandemic, convergent, intelligent communication services, such as online office, online education, online healthcare, and online government services, have witnessed a surge in growth.

As the pandemic continues, the market demand for videoconferencing is expanding horizontally and vertically. Horizontally, the market expects the quick and extensive adoption of such systems. Vertically, videoconferencing systems are expected to be deeply integrated with security, service quality, and internal service systems. This will make them easier to use and provide a better user experience.

Videoconferencing applications (such as WeLink) on large screens (such as the 98-inch IdeaHub) will be integrated with office systems (such as Office, CRM, and ERP) on computers, and connected to the app system on smartphones, offering a three-in-one integrated application experience with a large screen.

These applications feature security, SLAs, private lines, and E2E solutions. Their profit models are competitive and they have great potential for growth.

Intelligent home videoconferencing: In 2021, China Telecom launched gigabit visual networking, which integrates home security surveillance, gigabit video, and home videoconferencing applications to offer a new experience for high-end home users. On March 16, Huawei launched its FTTR-based All-in-One Smart Home solution to meet the needs of high-end home users for gigabit applications.

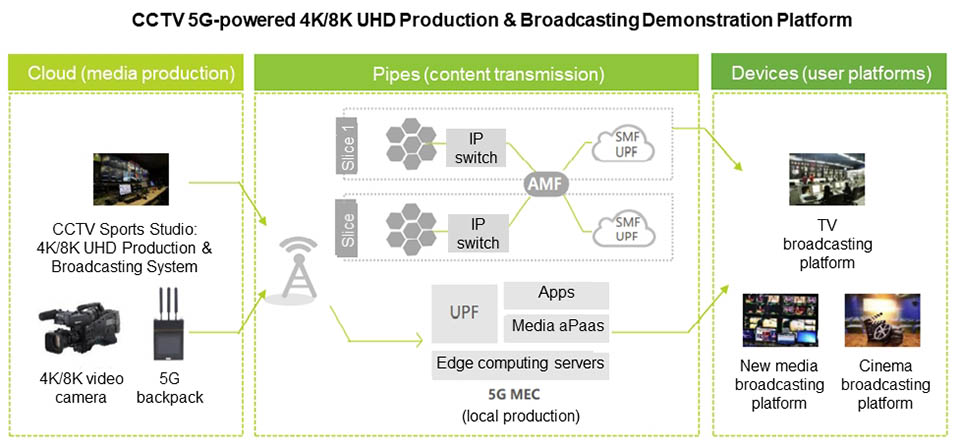

Live streaming of sports events over gigabit networks: Multi-angle, 8K/16K, AR/VR, and more new video technologies have been used to achieve breakthroughs in video solutions, boosting the growth potential of high-end commercial videoconferencing.

3. Gigabit solutions: Building experience and value-based competitiveness horizontally and vertically

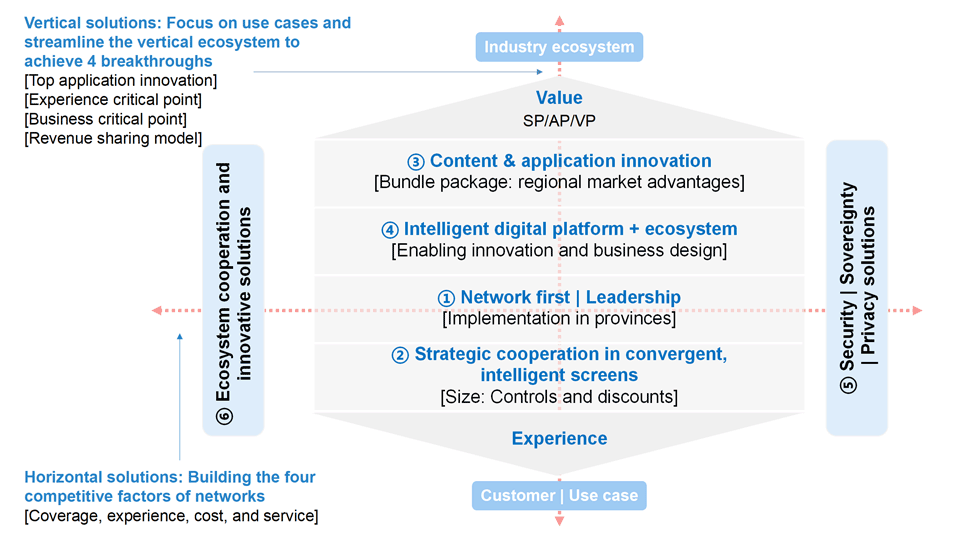

To implement new business, applications, and services, carriers need to deploy a set of innovative solutions based on gigabit networks. They can build up value-based horizontal competitiveness first and then vertical.

"Horizontal" means that they should build the best network in the industry to meet the experience and value-based needs of vertical services and applications. Therefore, horizontal solutions should focus on streamlining the topology of E2E network solutions and building superior gigabit networks to meet the needs for QoE/QoS, security, reliability, service quality SLA, capacity, coverage, cost, and services.

Figure 2: Technical specifications of the horizontal gigabit solutions (live network data in China in 2022)

"Vertical" refers to accurately identifying potential top applications that can drive user, traffic, and revenue growth in the four use cases, and working with or integrating application partners to achieve breakthroughs in application innovation. Currently, the core of the four major use cases is convergent, intelligent communication service applications. Devices are being integrated to achieve the convergence of large and small screens and of hardware and software.

Gigabit networks have the highest SLA and secure private line capabilities. Carriers can link the most powerful partners across devices, pipes, platforms, and applications through an ecosystem cooperation model for shared success. This aims to develop vertical solutions that are gradually iterated and optimized to meet the standards of experience and business value, and achieve sustainable user, traffic, and revenue growth.

Figure 3: Horizontal and vertical gigabit solutions

4. From excellence to beyond on the second development track

In the value distribution of the ecosystem, carriers dominate connections and traffic. Therefore, gigabit network connections and traffic represent the first development track for carriers.

In the development cycle of gigabit networks and industrial Internet, new technologies are usually taken as the second development track in industry planning. For example, carriers can develop and build capabilities in new services such as cloud, big data, artificial intelligence, IoT, video, private line, and green development.

Currently, global and industry-wide transformation practices have exposed a huge gap between practical results and objectives. Therefore, we need to keep the use cases in the market and provide customers with applications and services that offer new value based on their needs. Integrating fragmented technologies and products to build solutions that enable application innovation is what customers need and want.

An intelligent digital platform based on the convergence of networks and technologies, such as cloud, big data, artificial intelligence, and security, will enable carriers to upgrade services. Carriers can monetize data through platforms and monetize information through upgrading services to achieve growth on the second development track.

Government Support for Optical Fiber Can Boost Network Transformation

When carriers are not motivated to upgrade from copper to fiber upgrades, governments need to consider three main factors to guide the way forward, boost economic development, improve living standards, and transform industry.

New infrastructure projects are critical not only to digital economic development but the national competitiveness. For fixed networks, swapping copper for fiber is both a necessary step and crucial for the transition towards green networks. For mobile networks, 5G's low latency and massive connectivity need the power provided by optical networks. However, these necessary upgrades are progressing more slowly in some countries and regions because carriers lack the motivation to swap copper for fiber. A way to resolve this is through government involvement and cross-industry collaboration.

Three factors slowing copper-to-fiber upgrades

The fixed network broadband market in most regions is expected to stay relatively static over the long term, with copper-to-fiber upgrades advancing very slowly. Carriers currently lack sufficient motivation to deploy optical networks due to three main factors.

1. A lack of strategic drivers

The natural monopoly of fixed networks has resulted in a false balance between supply and demand. Since the 1990s, the global telecommunications industry has seen an upsurge in privatization, leading to the widespread belief that Western carriers are mostly privatized. However, other than carriers in the Americas, who are mostly privatized, nearly 50% of fixed-line and integrated tier-1 carriers in Europe and the rest of the world are still controlled by government. In a market where capital is dominant, state-controlled carriers can easily dominate or monopolize the market through inherited public assets, making it difficult for other players to compete at scale. Over time, this insufficient market competition leads to inefficient organizations, indirectly weakening network deployment capabilities.

The low return on investment typically seen with optical fiber also results in a lack of priority. While transmission over optical fiber is 10 to 100 times faster than over copper lines, new optical fiber deployment requires up to five times the investment of copper and yields a broadband service revenue increase of maybe 10%. In developed countries, carriers have used pricing to encourage and attract users to subscribe to all-optical home broadband services. French carriers set the prices of fiber-to-the-home (FTTH) packages and copper-line-based x digital subscriber line (xDSL) packages at similar levels. Spanish carriers also provide FTTH-based and ADSL-based home broadband packages at similar prices. This pricing strategy offers higher speed and quality for the same price, and provides higher-quality all-optical access to enhance user loyalty and keep churn rates low. In less developed countries and some developing countries, optical fiber deployment costs are directly reflected in carriers' package prices. For example, the initial cost of Gambian carriers' FTTH packages start at US$50 per month. This makes it harder for all-optical services to ramp up in countries with low per capita GDP. Because higher speeds don't bring in more revenue, higher quality doesn't lead to more users, and the fact that returns on copper-to-fiber investement is low, optical fiber deployment is not a natural priority in emerging markets.

2. A lack of technological drivers

A generational shift in technology cannot usually be driven by technological superiority or commercial forces alone. It typically also requires government intervention to be successful. The copper line industry is now mature. However, copper lines are being squeezed out in broadband applications and investments in many countries. Because mobile networks have outperformed fixed networks in coverage and penetration and perform similarly to fixed networks in terms of speeds and experience, many users are choosing Wireless-to-the-X (WTTx) solutions instead of Fiber-to-the-X (FTTx) solutions. In addition, governments are reallocating frequency bands to increase their revenues from auction fees, which naturally results in carrier investment plans that favor mobile networks. Without large-scale planning and deployment, ROI for all-optical network deployment takes longer, and technical superiority cannot effectively drive carrier decision-makers to make investment plans for all-optical access.

3. A lack of green drivers

Current climate protection efforts mainly focus on strengthening regulations on power generation and other energy-intensive industries, while constraints on the ICT industry are still imposed on a voluntary basis. Carriers have kept a watchful eye on reducing carbon emission, but are not taking immediate action in this area because energy conservation in fixed networks is not urgently needed.

In 2022, the EU carbon price exceeded €70 per ton, while the carbon price in China reached 60 Chinese yuan (approx. US$8.95) per ton. Despite this, purchasing carbon emission allowances remains a good approach for carriers' green initiatives. Why? According to China Mobile's carbon peak and carbon-neutrality action plan, the carrier's total telecom service volume is expected to increase by 1.6 times by the end of the country's 14th Five-Year Plan, while its total expected carbon emissions will be limited to 56 million tons. In 2021, the carrier's revenue reached 848.3 billion Chinese yuan, capital expenditure (CAPEX) reached 183.6 billion, and net profits reached 116.1 billion. The cost of purchasing a large enough carbon emissions allowance to achieve carbon neutrality by 2025 would only take 1.83% of its CAPEX and 2.9% of its net profits. This expense is well within the carrier's means. Many carriers are committed to mid- and long-term energy transformations, but carbon reduction and energy conservation are not strong enough motivators to drive carriers to accelerate short-term investments or conduct large-scale copper replacement.

Three factors for consideration by governments

It is important for governments to see the strategic value of patience in this area and promote reasonably paced industry upgrades toward all-optical solutions. Governments must take into account the economic growth, social benefits, and industry development that such transformation would achieve, and increase investment to promote the deployment of fiber network infrastructure.

1. Economic growth

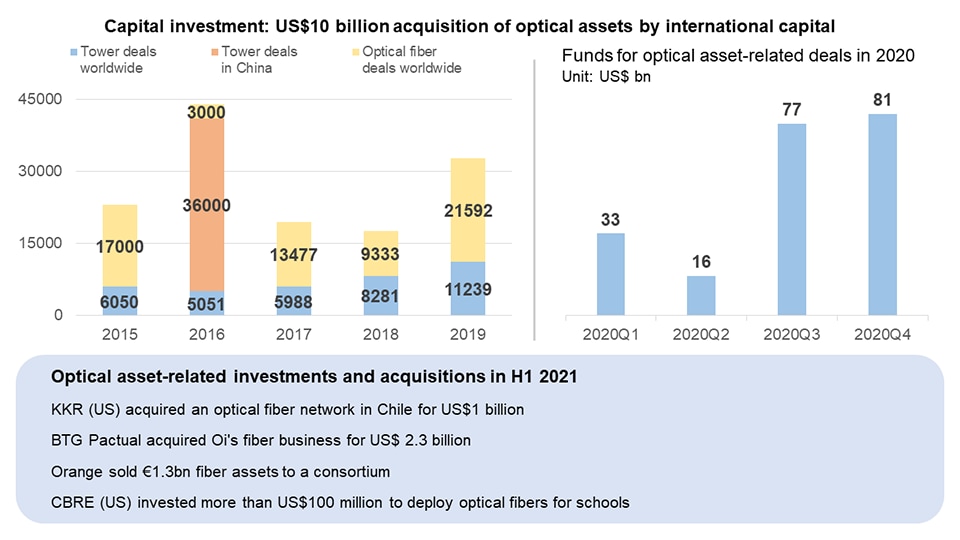

The digital economy is the way to the future. According to the Annual Report on China's Mobile Internet Development (2021), China's digital economy was worth 39.2 trillion Chinese yuan in 2020, accounting for 38.6% of GDP growth, with that figure growing by 9.6% annually. The digital economy is serving as a key driver of stable economic growth in China. The European Central Bank also states in the report The digital economy and the euro area that "digital adoption has increased notably since 2015", and "the Digital Economy and Society Index has risen from below 40 in 2015 to above 60 in 2020." In West European countries in particular, such as Germany, the ICT-related digital economy experienced rapid growth around 2016, faster than even real GDP growth. This increased government perceptions of the importance of the digital economy, and drove them to start planning and promoting the construction of digital infrastructure. International capital is also shifting from investment into tower construction to acquiring optical fiber assets. Many governments have also realized the importance of getting involved in digital infrastructure construction and driving capital investment.

Figure 1: Capital investment: International capital's acquisition of optical assets

2. Social benefits

The pandemic has dramatically changed the way people live. Applications such as distance education, telecommuting, and cloud-based travel are acting as catalysts for the digital and green transformation of society. This means digital infrastructure is needed for a resilient modern society. An independent report released in April 2020 by Assembly Consulting Group, a consulting firm commissioned by Huawei, put forward a quantitative estimation for the UK market, "The gigabit market in the UK will drive the digital economy to grow by US$51.3 billion by 2025, enabling millions of people to work at home, which is equivalent to reducing the energy consumption and emissions of traveling 3 billion kilometers by car." This reflects the social benefit that gigabit optical networks bring in terms of not just the digital economy, but also in reducing carbon emissions.

3. Industry development

Market revitalization requires both capital and government involvement. When the former German chancellor Angela Merkel visited China in 2016, she proposed linking Germany's Industry 4.0 strategy with China's Made in China 2025 strategy. This promoted the importance of digital infrastructure, and increased government attention on the digital transformation of traditional industries and digital development of the ICT industry. Subsequently, many countries developed or accelerated the implementation of their own national ICT strategies. Individual nations across Europe and Africa, including France and Nigeria, have issued a range of national broadband deployment plans for their ICT industries to lead the way to the future. In addition, the cost of optical fibers and optical cables worldwide dropped sharply in 2019, and fiber deployment techniques, including micro-trenching, air blowing, and fiber splicing-free techniques, have become increasingly mature, which means all-optical infrastructure is becoming more popular than ever. This sharp reduction in fiber deployment costs also means that it is time for governments to get involved in the market to accelerate all-optical deployment and advance industry digitalization.

Figure 2: Changes of the optical fiber price in China (unit: CNY/core-kilometer)

We can look at how Western European countries typically use government power to accelerate all-optical deployment by turning to the example set by the UK's network development strategy. The UK launched its forward-looking broadband network deployment strategy, Building Digital UK (BDUK), in 2013. Early on, the government set a broadband rate target of 24 Mbit/s, upheld technology neutrality, and turned to copper-based, very-high-speed digital subscriber line 2 (VDSL2) technology to develop their broadband networks. However, in response to the new French government's decision to accelerate all-optical network deployment in 2017, the British government acknowledged the importance of optical fiber development by proposing the Local Full Fibre Networks Programme (LFFN) in 2018. At that time, LFFN only covered 13 pilot areas and did not promote full-scale deployment of fiber networks. In 2019, Prime Minister Boris Johnson raised an all-optical deployment proposal during his election campaign. After taking office, he and the new cabinet started planning all-optical development policies and launched Project Gigabit in March 2021. Through Project Gigabit, the government will invest £5 billion to drive private investment of £12 billion from carriers and ensure at least 85% of gigabit coverage is based on fiber access throughout the UK by 2025. It is clear that government involvement was the biggest driver of the copper-to-fiber upgrade in this case.

Monetizing RBT in the Video Era

The RBT service is a value-added service through which carriers possess a strategic control point and a native profit model. Can today's video RBT service replicate the glory of the voice RBT days?

4G changed the world. With the development of 4G networks, the evolution of scenario-based innovations for mobile Internet led to leading applications in the megabit era such as TikTok and Kwai. If video RBT can be innovative enough to deliver value and experience comparable to these apps and become a major part of the professional user-generated content (PUGC) industry, it could evolve into another killer application.

Back when China Mobile was developing its RBT services, voice RBT alone accounted for 3.4% of the carrier's total revenue, topping the global market based on user numbers and revenues in the voice era. Today, the video RBT market is gaining traction. Currently, the penetration rate of China Mobile's video RBT users is about 20% to 30%, generating an annual revenue of 7 to 8 billion Chinese yuan (US$1.046 billion to US$1.195 billion), with a high gross margin. However, it should also be noted that video RBT only accounts for 1% of China Mobile's total revenue, a ten-fold gap compared with voice RBT in the voice era. Video RBT users are mostly found in the high-end 20%, while the 20% to 80% range where most revenue is generated has yet to be tapped. This means that the video RBT market has a growth potential of twofold to fivefold.

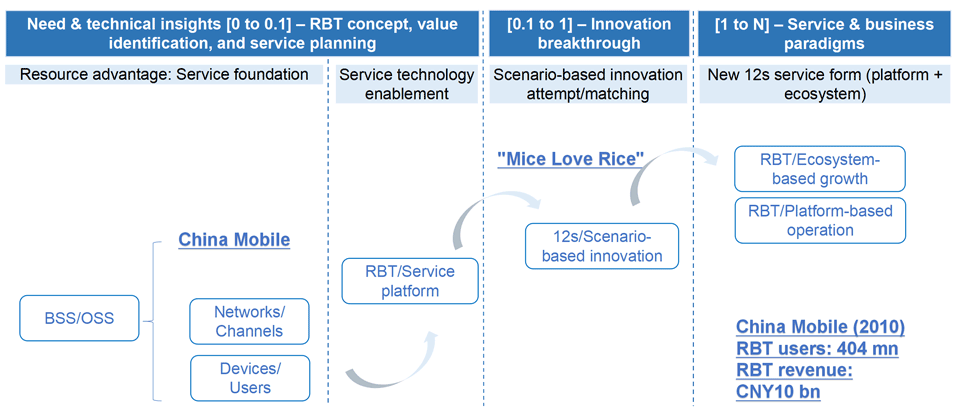

I. From 0 to 1

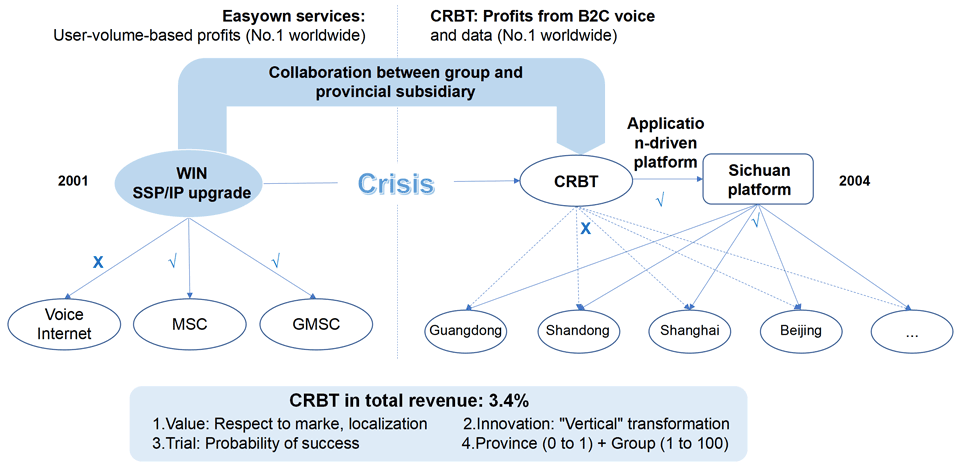

Charting the trajectory of voice RBT's success can give us insights into developing video RBT today. The 0-to-1 innovative breakthrough of voice RBT was based on the following factors:

1. Strong RBT distribution platform through WIN (Wireless Intelligent Networks)

The RBT service was not proactively driven by carriers' marketing and data departments. Instead, it was an open and tentative attempt by vendors and carriers' network departments to retain independent SSP/IP as a backup to address SSP/IP termination while ensuring the stable performance of (G)MSC/SSP/IP networks. In 2001, the target WINs were upgraded and more than 1,000 (G)MSCs had SSP/IP functions integrated. The 44 overlaid independent SSPs/IPs in the live WINs faced the challenge of termination. At the same time, the network department issued a document, specifying that independent SSPs/IPs with idle service volumes should be retained, and it worked with vendors to develop four innovative solutions to continue using the equipment after the SSP/IP retention period ended. The switching and voice capabilities that resulted from the SSP/IP redundancy provided fundamental platforms and resources for the innovation of new services. IP, however, proved its maturity as a voice distribution enabling platform and laid a strong foundation for the development of RBT. Retrofitting Huawei's SSP/IP to a CRBT platform became an option, which ensured a premium experience of music RBT on mobile networks.

Figure 1: Voice RBT emerged as a result of wireless intelligent network development

2. Everything was ready for the launch of the RBT service

The number of China Mobile's GSM users grew from 100 million to 500 million over the decade of prosperity for the prepaid service model. This inspired carriers to discover the opportunities in the telecom industry. In addition, the prosperity of the pop music industry in the late 1990s stimulated creativity and talent in the music industry. Moreover, in the 2000s, as the cassette- and CD-based music distribution model hit a bottleneck, the industry needed to switch tracks to grow. That was when the market and technical conditions for voice RBT reached a tipping point.

3. Content breakthrough as the song "Mice Love Rice" shattered the 8 –12s value bottleneck

From March to June 2001, after China Mobile launched the RBT service, the carrier gathered a range of partners in the music industry with the aim of integrating leading tracks into the RBT DSM distribution platform. However, the market response was lukewarm. The potential of the RBT market was finally unleashed when the pop song "Mice Love Rice" received more than 6 million downloads in Sichuan, a large province of 100 million people. The song was by no means the most popular in the music market, but it fit perfectly for the 8 –12s timeframe when a caller waited for their call to be answered. The song was ideally suited for RBT and helped propel the industry into a golden period of growth.

4. Revenue sharing for entrusted charging was a development model for shared success

The emergence of RBT was an opportunity for both the telecom industry and the music industry, with the 1:9 and 2:8 profit models meeting both industries' needs for value. It was never easy for music to go Platinum through conventional channels, but popular RBT music could exceed one million downloads overnight. This drove musicians and music production companies in and outside of China to shift their focus to RBT music. As a result, the RBT business saw a boom in content innovation.

Figure 2: RBT was an example of groundbreaking solution innovation in the voice era

Reflecting on the journey of service innovation and market development of voice RBT in 2001, we can see that the development of RBT services was both fortuitous and inevitable.

2. The focal points of video RBT innovation

The development of the mobile Internet has spawned new digital lifestyles in the digital economy, accelerating the transition from voice-based services to video-based services. Netflix, TikTok, and Kwai now rank among the top platforms in multiple mobile Internet markets worldwide in terms of downloads, proportion in DOU, and proportion of user hours online. The video RBT service is a high-value niche-market video service with a readily available profit model, and is well positioned to unlock new growth potential in the long-tailed market beyond the dominance of the top video apps.

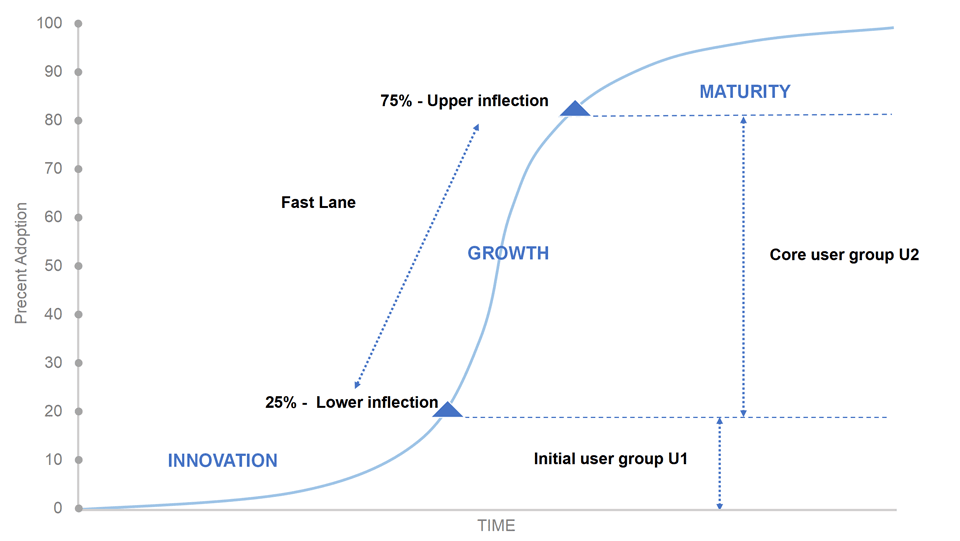

Figure 3: The 25% bottleneck is both a challenge and a leapfrog opportunity for video RBT

The S-shaped growth curve is generally applicable to any service. The current penetration rate of China Mobile's video RBT service falls within the 20 to 30% range around the lower inflection. The main challenge now is to seize the rapid growth opportunities that follow the lower inflection in the S-curve to propel the business momentum for exponential growth.

Opportunities for growth always exist, but the basic principles of making them a reality are to meet market and customer needs, and to drive user expansion and revenue growth using innovative solutions and marketing strategies.

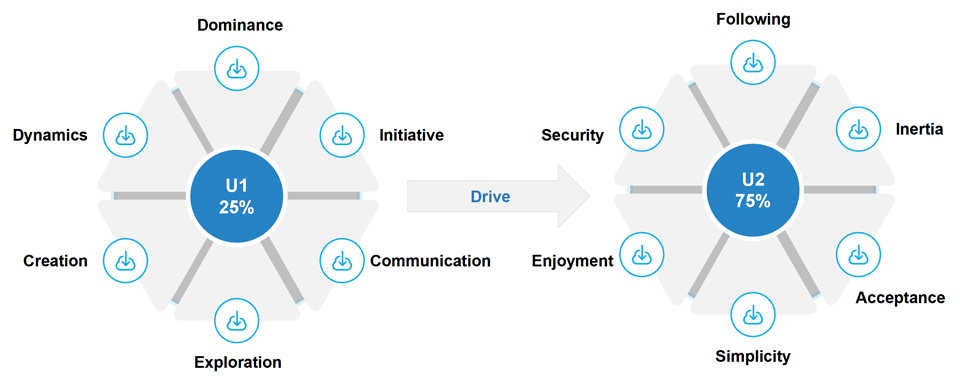

1. Customer analysis: From the initial user group U1 to core user group U2

The top priority of innovative solutions and marketing strategies is to gain insights into customers. Initially, the early-adopter user group U1 dominates when the penetration rate is less than 25%. The next stage U2 comprises the core user group when the penetration rate is between 25% and 75%. U2 and U1 have distinct needs. U1 users are characterized by dominance, initiative, communication, exploration, creation, and dynamics, while U2 is characterized by the needs and behaviors that include following, inertia, acceptance, simplicity, enjoyment, and security. U1 consists of seed users who open up the market and proactively spread the service, whereas U2 comprises a robust ecosystem that expands the size and value of the market. U1 drives and triggers U2.

Figure 4: U1 is the seed user group, and U2 is the expanded user group. U1 drives U2

2. PUGC innovation for the 8 –12s connecting time frame

For the video RBT service, the 8 –12s connection timeframe has not changed, and users still need the RBT to be soothing without being distracting. However, video RBT should also fit the characteristics of mobile video PUGC in the same way that the leading video apps do, instantly creating joy and value for users.

3. Satisfying user experience based on data analytics

When China Mobile develops the new user group in the 25%–73% range, it will be important to classify users in the U1 group, analyze the consumption data of different types of users, and find the most popular video RBT content. Utilizing the influence of U1 on U2, the carrier can then proactively push the top content to U2 to trigger U2 subscriptions and usage. This marketing model that recommends and pushes content based on data analytics is the "killer move" behind the success of TikTok and fits the growth curve of the mobile video era.

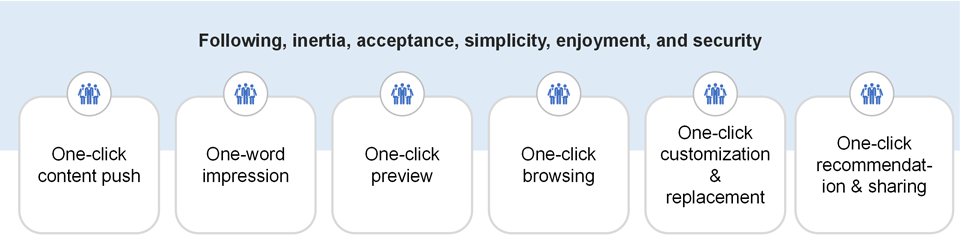

For U2 users, a "one-click" experience is needed. For example:

- One-click content push: Carriers should take advantage of their security SMS channels and push popular content based on user classification and requirement data analytics.

- One-word impression: The SMS title and recommendation copy should be designed to be brief and impactful.

- One-click preview: Users should be able to easily preview recommended content on the SMS interface. This would ensure that the content reaches at least 80% of users.

- One-click browsing: The browsing interface should resemble TikTok and allow users to preview the top five pieces of recommended content by swiping down.

- One-click customization and replacement: One-click customization and replacement buttons should be placed on the browsing interface to allow users to subscribe to the service as they view content.

- One-click recommendation and sharing: A button should be provided on the browsing interface to enable U1 users to recommend and share content to U2 users through a simple tap.

Figure 5: Upgraded one-click video RBT solution for U1 to drive U2

Video RBT is becoming a marketing and advertising channel for enterprises and public institutions. Striking a balance between marketing needs and value to customers makes it easier to create video content that can spread across different user groups. The popular video The Divine Damsel of Devastation made for the game Genshin Impact cleverly combines Beijing Opera with multi-angle video technology and the game ’s story. The video went viral soon after its release due to its stunning artistry, helping to not just promote the game, and also generate profit itself.

New video RBT carriers can now approach the business by directly addressing U2 users. They can conduct precision marketing to develop user groups through user classification and data analytics, as well as the proactive pushing of popular content.

This will make work easier for carriers and give them a latecomer advantage.

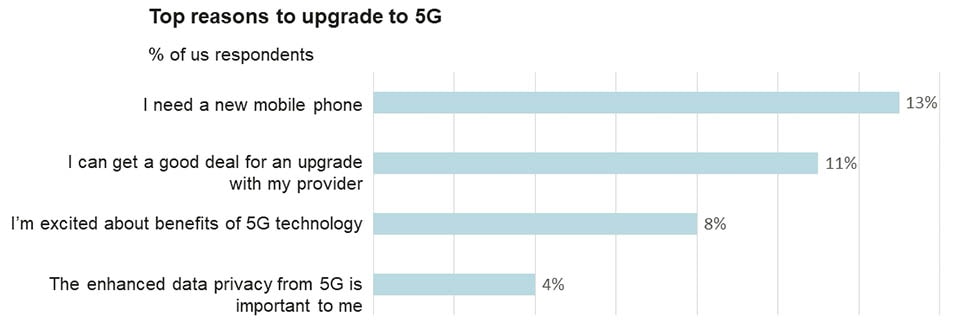

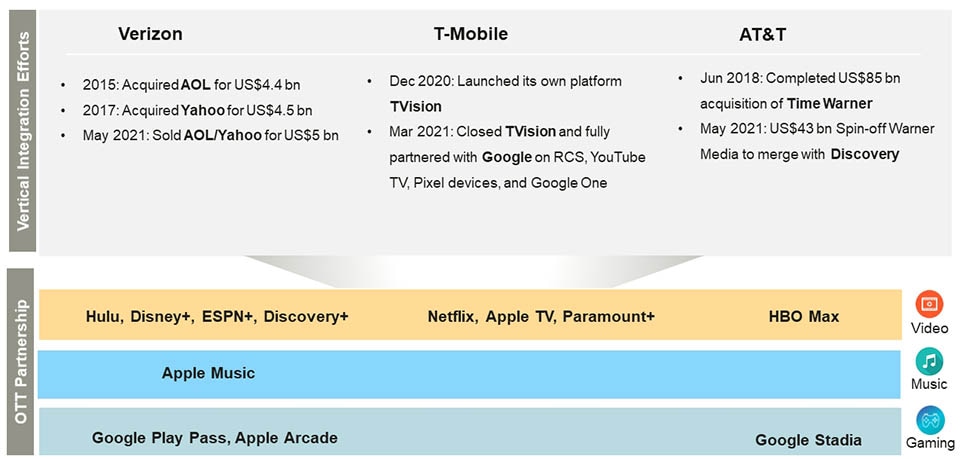

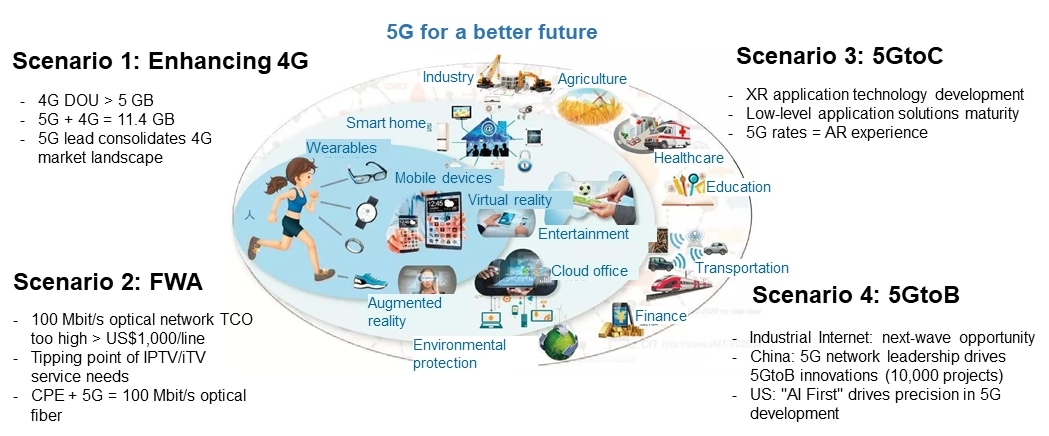

Behind the Early Success Stories of 5G

Leading 5G operators' pragmatic quick-win approaches via traffic monetization, device upgrades, and content services.

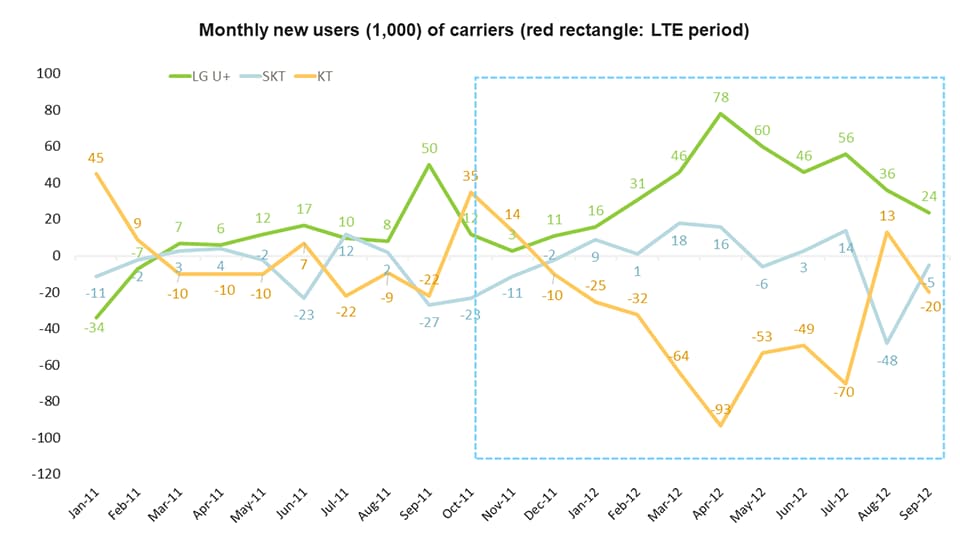

Back in April 2019, South Korean carriers took the lead in launching 5G and achieved first-mover success. LG U+, for example, has achieved year-over-year growth in wireless service revenue for 13 consecutive quarters, reversing the downturn seen before 2018. Financial reports from the carrier reveal that its wireless service revenue increased by 14% in 2022 Q1 over 2019 Q1, shortly before 5G was commercially launched.

The Korean model is hard to replicate?

South Korea's 5G development model is often considered difficult to replicate for two main reasons.

- First, for network deployment, it appears that South Korean carriers have invested heavily in achieving quick nationwide coverage, regardless of the CAPEX spike. That is not how most carriers approach network deployment.

- Second, as South Korean carriers are part of a large conglomerate, they can operate in-house content platforms and invest substantially in original content. This is out of reach for many carriers.

Let us look at LG U+ as an example of a carrier that has adopted the “invest early ”strategy:

- Early Launch: Back in the early days of LTE, LG U+ managed to launch LTE about 6 months earlier than KT, allowing it to attract the most LTE subscribers in the first few months and increase its overall market share.

Figure 1: LG U+ took early lead in LTE launch in Q3 2011(Source: LG U+ 2012Q3 Financial Reports)

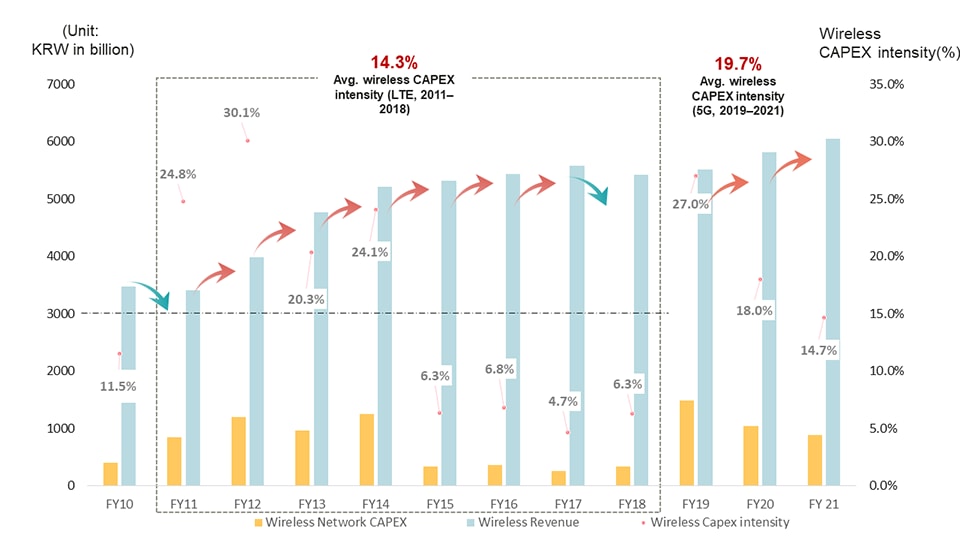

- Early Execution: As shown in Figure 2, despite LG U+'s rather high wireless CAPEX intensity (20% - 30%) in the first four years of LTE, this number dropped to 14.3% if we look at the average intensity over the LTE period from 2011 to 2018 –a modest figure compared to the global average CAPEX intensity of about 16%. With this strategy, advance investment in the first four years of LTE led to seven years of continuous growth in wireless service revenues. Since 2019, 5G has driven a new round of wireless service revenue growth.